- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

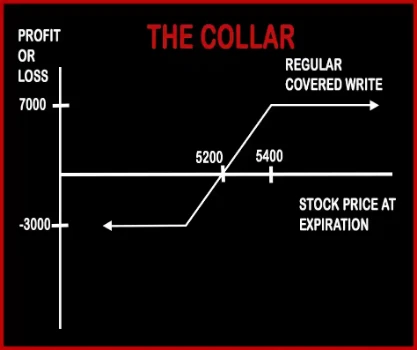

THE COLLAR

The Collar Option Strategy

Collar Strategy is an extension to Covered Call Strategy. A trader, who is bullish in nature but has a very low risk appetite and wants to mitigate his risk will implement the Collar Strategy. Collar involves buying of stock in either Cash/Futures Market, buying an ATM Put Option & selling an OTM Call Option. The expiry dates of the options should be same. Here the long position will make profits if things go as per plan i.e. stock gains. The put option will cover the losses if things go in the opposite direction. The profits will be limited on account of the sale of an OTM Call Option.

Risk: Limited

Reward: Limited

Example

Mr. X is bullish on NIFTY and expects it to rise, but also very conservative in nature. He deploys Collar Strategy where he buys the underlying stock in the futures market, sells an OTM Call Option & buys 1 ATM Put Option. Now his net position is safe from adverse movements in any direction either down or up. Lot size of NIFTY is 50. He buys one NIFTY futures at 5200, sells one 5400 OTM Call Option at a premium of Rs.25 & buys one 5200 ATM Put Option for a premium of Rs.85.

Case 1: At expiry if NIFTY closes at 4900, then Mr. X will make a loss of Rs.3000. [{(25)-(300) + (300-85)}*50]

Case 2: At expiry if NIFTY closes at 5200, then Mr. X will make a loss of Rs.3000. [(25-85)*50]

Case 3: At expiry if NIFTY closes at 5500, then Mr. X will make a profit of Rs.7000. [{(25-100) - (85) + (300)}*50]

Comments for THE COLLAR

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments