- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

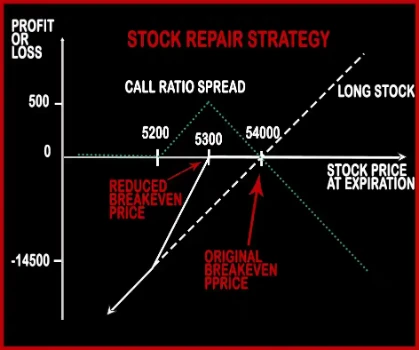

STOCK REPAIR

Stock Repair Option Strategy

Stock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery.

Suppose Mr. X has purchased 1 lot of NIFTY Futures at 5400. Lot size of NIFTY is 50. Assume currently NIFTY is trading at 5200 translating it into loss of Rs. 10000 on his long position in future. (200*50) Now, Mr. X wants to repair his position so he implements Stock Repair Strategy by buying 1 5200 NIFTY ATM Call Option at a premium of Rs.100 and selling 2 5300 NIFTY OTM Call Options for a premium of Rs.110 (55*2). By implementing this strategy Mr. X’s account will get credited by Rs.500. [(100-110)*50]

Case 1: At expiry if NIFTY closes at 5100, then Mr. X will make a loss of Rs.14500. [{(5100-5400) – (100) + (55*2)}*50]

Case 2: At expiry if NIFTY closes at 5300, then Mr. X will make a profit of Rs.500. [{(5300-5400) – (100-100) + (55*2)}*50]

Case 3: At expiry if NIFTY closes at 5500, then Mr. X will make a profit of Rs.500. [{(5500-5400) + (300-100) – ((200-55)*2)}*50]

Comments for STOCK REPAIR

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments