- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

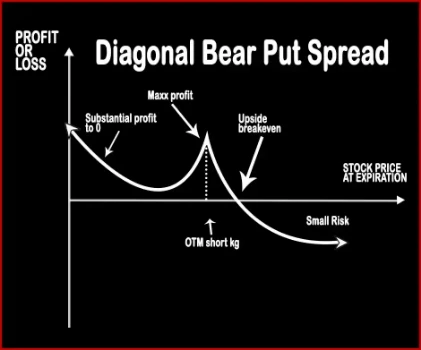

DIAGONAL BEAR PUT SPREAD

Diagonal Bear Put Spread

When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk.

Risk: Limited

Reward: Limited

Construction

Sell 1 Near-Month OTM Put Option

Buy 1 Mid-Month ITM Put Option

Example

Suppose NIFTY is trading at 5300 levels, Mr. X is neutral to bearish in the near-month and is bearish in the mid-month; hence he will apply Diagonal Bear Put Spread. He will sell 15200 NIFTY Near-Month OTM Put Option for a premium of Rs.10 and buy 15400 NIFTY Mid-Month ITM Put Option at a premium of Rs.145. His net investment will be Rs.6750. [(10-145)*50]

Case 1: If at the near-month expiry, NIFTY closes at 5100 levels, then Mr. X will incur a loss on the 5200 NIFTY Near-Month OTM Put Option of Rs. 4500. [(100-10)*50] If at the mid-month expiry, NIFTY closes at 5000 levels, then Mr. X will make a profit on the 5400 NIFTY MidMonth ITM Put Option of Rs.12750. [(400-145)*50] His net payoff will result in a profit of Rs.8250. (12750-4500)

Case 2: If at the near-month expiry, NIFTY closes at 5300 levels, then Mr. X will get to keep the premium of 5200 NIFTY Near-Month OTM Put Option of Rs.500. (10*50) If at the mid-month expiry, NIFTY closes at 5200 levels, then Mr. X will make a profit on the 5400 NIFTY MidMonth ITM Put Option of Rs.2750. [(200-145)*50] His net payoff will result in a profit of Rs.3250. (2750+500)

Case 3: If at the near-month expiry, NIFTY closes at 5500 levels, then Mr. X will get to keep the premium of 5200 NIFTY Near-Month OTM Put Option of Rs.500. (10*50)

If at the mid-month expiry, NIFTY closes at 5000 levels, then Mr. X will lose the premium paid for the 5400 NIFTY Mid-Month ITM Put Option of Rs.7250. (145*50) His net payoff will result in a loss of Rs.6250. (500-7250).

Comments for DIAGONAL BEAR PUT SPREAD

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments