- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

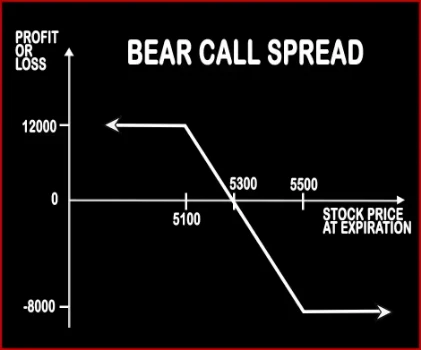

BEAR CALL SPREAD

Bear Call Spread Option Strategy

Bear Call Spread option trading strategy is used by a trader who is bearish in nature and expects the underlying asset to dip in the near future. This strategy includes buying of an ‘Out of the Money’ Call Option and selling one ‘In the Money’ Call Option of the same underlying asset and the same expiration date. When you write a call, you receive premium thereby reducing the cost for buying of OTM Call Option. This strategy is also called as ‘Bear Call Credit Spread’ as your account gets credited at the time of entering the positions.

Risk: Limited

Reward: Limited

Suppose that the NIFTY is trading around 5300 level, and Mr. X enters into Bear-Call-Spread strategy. The Lot Size of NIFTY is 50. He buys one 5500 OTM Call Option for a premium of Rs.35, and sells one 5100 ITM Call Option for Rs.275. His account will be credited by Rs12000. [(275-35)*50]

Case 1: At expiry, if the NIFTY closes at 5000 level, then Mr. X is allowed to keep the credit amount i.e. Rs.12000.

Case 2: At expiry, if the NIFTY closes at 5200 level, then the trader will make a profit of Rs.7000. [{(275-100) - (35)}*50]

Case 3: At expiry, if the NIFTY closes at 5600 level, then Mr. X would have made loss on the short position of 5100 which will be mitigated by profits made in the long position of 5500. The loss amount would be Rs.8000. [{(100-35) – (500-275)}*50]

Comments for BEAR CALL SPREAD

1 comments

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

Cheap Stock

Cheap Stock Brokers is a reputable and trusted firm in the Stock Advisory sector. Their services include suggesting the best stock brokers and best demat accounts in India and providing stock suggestions for intraday trading, long-term holdings, and mutual funds. They offer advisory and brokerage services to experienced clients and guide new investors and traders in the market. Join their platform to start your journey towards profitable trading. Visit us: https://cheapstockbroker.com

JCfUZQsq