- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

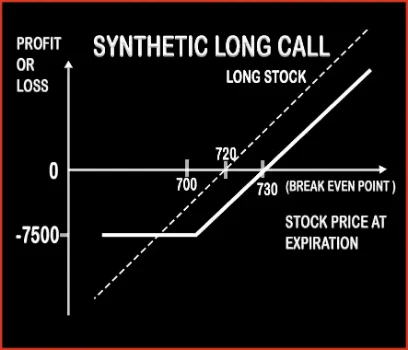

SYNTHETIC LONG CALL

Synthetic Long Call Option Strategy

A trader is bullish in nature for short term, but also fearful about the downside risk associated with it. Here, a trader wants to hold an underlying asset either in physical form like in case of commodities or demat (electronic) form in case of stocks. But he is always exposed to downside risk and in order to mitigate his losses, he will buy 1 ATM or OTM Put Option since ITM Put option will carry more premium than ATM & OTM Put options which are relatively cheap.

Case 1: If the prices rise as per his calculations, he will make unlimited profits on his long position in spot/cash market.

Case 2: If the prices fall, then his loss is covered by the Put Option. The loss incurred will be the premium amount paid to buy Put option.

The net position created from Synthetic Call strategy is similar to Call Option buy strategy.

A major difference exists between buying a Call Option and Synthetic Call strategy. In a plain Vanilla Call Option you do not hold the underlying asset, whereas in Synthetic Call you will hold the underlying asset and reap the benefits of dividends, bonus issues, etc. (only in case if the underlying asset is a stock)

Example

RIL is trading at Rs.720 levels, Mr. X is bullish in the long term, but wants to hedge himself from the fall in cash strategy goes wrong. He will buy 250 shares of RIL from the cash market @ Rs.720 and buy 1 700 Put Option @ Rs.10 as premium. The lot size of RIL is 250.

His net investment will be Rs.180000. [(250*720) + Rs.2500(250*10) = Rs.182500]

Reward: The gains will be unlimited since it’s a long position. His maximum loss will be Rs.2500 assuming

he will hold his cash position irrespective of the price. Break-Even Point for the net position will be Rs.730.(720+10)

Case 1: If RIL dips to Rs.690, then his net loss payoff will be Rs.7500. [{(690-720) + (10-10)}*250]

Case 2: If RIL closes at Rs.720, then his net loss payoff will be Rs.2500. [{(720-720)-(10)}*250]

Case 3: If RIL rises up to Rs.750, then his net profit payoff will be Rs.5000. [{(750-720)-(10)}*250]

Comments for SYNTHETIC LONG CALL

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments