- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

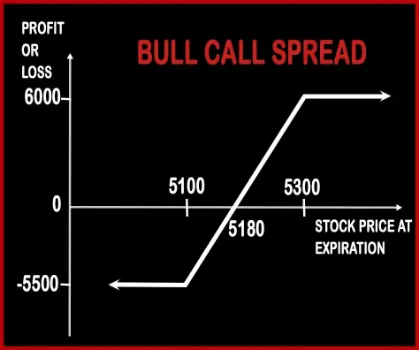

BULL CALL SPREAD

Bull Call Spread Option Strategy

Bull Call Spread option trading strategy is used by a trader who is bullish in nature and expects the underlying asset to give decent returns in the near future. This strategy includes buying of an ‘In The Money’ Call Option and selling of ‘Deep Out Of the Money’ Call Option of the same underlying asset and the same expiration date. When you write a call, you receive premium which results in reducing the cost for buying an ITM Call Option. However, the profits are also minimized in case of a windfall rise in the underlying asset’s price. This strategy is also called as ‘Bull Call Debit Spread’ as your account gets debited while deploying the strategy.

Risk: Limited

Reward: Limited

Suppose that the NIFTY is trading around 5180 level, and Mr. X enters into Bull-Call-Spread strategy. Lot Size of NIFTY is 50. He buys one 5100 ITM Call Option for a premium of Rs.165, and sells one 5300 OTM Call Option for Rs.55. The net investment will be only Rs.5500 [(165-55)*50], after premium received from writing the 5300 call.

Case 1: At expiry if the NIFTY dips down to 5000 level, the maximum loss will be only Rs.5500 (Investment Value).

Case 2: At expiry if the NIFTY closes at 5200 level, net profit will be Rs.6000. [{(55) - (100-165)}*50]

Case 3: At expiry if the spot NIFTY closes at 5400 level, the intrinsic value of the 5100 ITM call will be Rs.300 and that of 5300 OTM call will be Rs.100. At expiry, the cash settlement will be done with a credit of Rs.4500. [{(300-165) - (100-55)}*50]

Comments for BULL CALL SPREAD

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments