- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

SHORT STRANGLE

Short Strangle Option Strategy

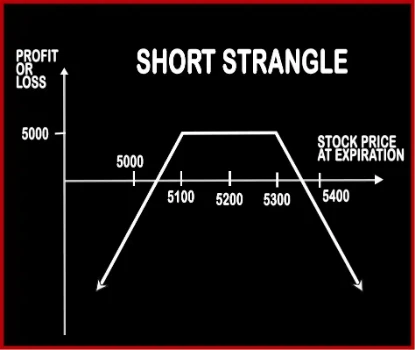

This strategy is similar to Short Straddle; the only difference is of the strike prices at which the positions are built. Short Strangle involves selling of one OTM Call Option and selling of one OTM Put Option, of the same expiry date and same underlying asset. Here the probability of making profits is more as there is a spread between the two strike prices, and if the markets do remain less volatile, then this strategy will start making profits for traders. The ideology behind this strategy is that the market will not be much volatile in the near future and the expected volatility will lie between the 2 strike prices. This strategy is used by expert traders who quantify the implied volatility accurately.

Risk: Unlimited

Reward: Limited

Suppose NIFTY is trading around 5200 odd points, Mr. X does not expect the market to move much in the near future. As he is neutral about the volatility of NIFTY he will enter in a Short Strangle Strategy. He will sell 1 5300 OTM Call Option for a premium of Rs.55 & sell 15100 OTM Put Option for a premium of Rs.50. The lot size of NIFTY is 50. Hence, his account will get credited by Rs.5000. [(50+50)*50]

Case 1: At expiry if NIFTY closes at 5000, then Mr. X will neither make profit nor loss. His net cash flow will be 0. [{(50)-(100-50)}*50]

Case 2: At expiry if NIFTY closes at 5250, then Mr. X will make a profit of Rs.5000. [(50+50)*50]

Case 3: At expiry if NIFTY closes at 5400, then Mr. X will neither make profits nor losses. His net cash flow will be 0. [{(100-50)-(50)}*50]

Comments for SHORT STRANGLE

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments