- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

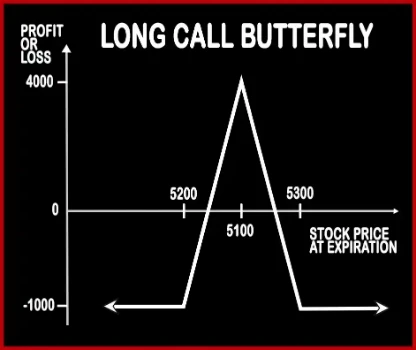

LONG CALL BUTTERFLY

Long Call Butterfly Option Strategy

A trader, who is neutral in nature and believes that there will be very low volatility i.e. expects the market to remain range bound, will implement this strategy. This strategy involves selling of 2 ATM Call Options, buying 1 ITM Call Option & buying 1 OTM Call Option of the same expiry date & same underlying asset. The difference between the strikes should be equal.

If the market remains range bound then this strategy will start making profits. If the market moves out of strike range in either way, then it will start making loss. The loss generated will also be capped.

Risk: Limited

Reward: Limited

Suppose that NIFTY is trading at 5200 levels, Mr. X thinks that there is low volatility in the market and expects it to stay between a certain range, then he will implement the Long Call Butterfly Strategy. He will sell 2 NIFTY 5200 ATM Call Options for a premium of Rs.200 (100*2), buy 1 NIFTY 5100 ITM Call Option at a premium of Rs.165 & buy 1 NIFTY 5300 OTM Call Option at a premium of Rs.55. The net investment will only be Rs.1000. [{(100*2)-(165)-(55)}*50]

Case 1: At expiry if NIFTY closes at 4900, Mr. X will make a loss of Rs.1000. [{(100*2)-(165)-(55)}*50]

Case 2: At expiry if NIFTY closes at 5200, Mr. X will make a profit of Rs.4000. [{(100-165) + (100*2)-(55)}*50]

Case 3: At expiry if NIFTY closes at 5400, Mr. X will make a loss of Rs.1000. [{(300-165) - ((200-100)*2) + (100-55)}*50]

Comments for LONG CALL BUTTERFLY

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments