- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

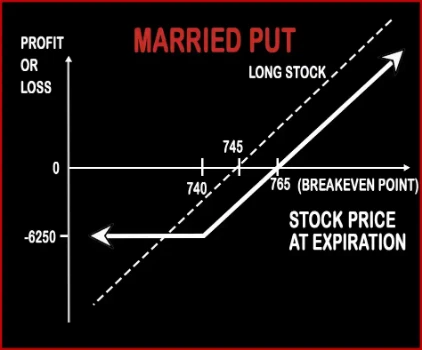

MARRIED PUT

Married Put Option Strategy

This strategy is applied when trader goes long on the underlying asset i.e. he buys the stock in cash market. He has a bullish view and expects the market to rise in the near future, but simultaneously has the fear of downward movement of the markets. In order to cover his position from vulnerabilities he buys one ATM Put Option of the same underlying asset. Here, a trader will receive all the gains from dividends, bonus issues since he is holding long positions in the cash market.

Risk: Limited

Reward: Unlimited

Example

Suppose that RIL is trading at Rs.745, and Mr. X is bullish on the market. He buys 250 RIL shares in the cash market. Now the risk always persist (downward move) and to cover himself from this adverse move he will buy one 740 RIL ATM Put Option at a premium of Rs.20. His total investment will be Rs.191250.[(745+20)*250]

Case 1: At expiry if RIL closes at Rs.710, then Mr. X will make a loss of Rs.6250. [{(710-745) + (30-20)}*250]

Case 2: At expiry if RIL closes at Rs.740, then Mr. X will make a loss of Rs.6250. [{(740-745) – (20)}*250]

Case 3: At expiry if RIL closes at Rs.770, then Mr. X will make a profit of Rs.1250. [{(770-745) – (0-20)}*250]

Comments for MARRIED PUT

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments