- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

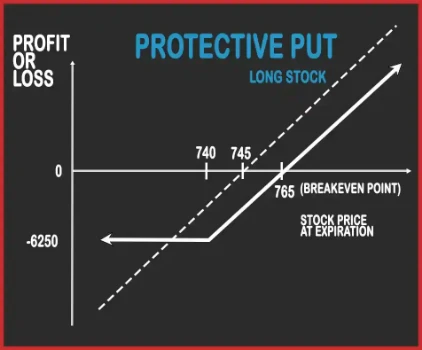

PROTECTIVE PUT

Protective Put Option Strategy

Protective Put Strategy is a hedging strategy where trader guards himself from the downside risk. This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. He will buy one ATM Put Option to hedge his position. Now, if the underlying asset moves either up or down, the trader is in a safe position.

Risk: Limited

Reward: Unlimited

Suppose that RIL is trading at Rs.745 and Mr. X buys 250 shares in the Cash Market. He will buy One 740 ATM Put Option at a premium of Rs.20 to hedge his long position. His net investment will be Rs.191250. [(745+20)*250]

Case 1: At expiry if RIL closes at Rs.710, then Mr. X will incur a loss of Rs. 6250. [{(710-745) + (30-20)}*250]

Case 2: At expiry if RIL closes at Rs.740, then Mr. X will incur a loss of Rs. 6250. [{(740-745)-(20)}*250]

Case 3: At expiry if RIL closes at Rs.770, then Mr. X will make a profit of Rs. 1250. [{(770-745)-(20)}*250]

Note: It is observed that once the stock starts moving up, the time value of Put will shrink half times the cash price. This will also depend on the number of days left in the expiry. A professional trader can also keep a stop loss in ATM Put once stock rallies sharply.

Comments for PROTECTIVE PUT

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments