- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

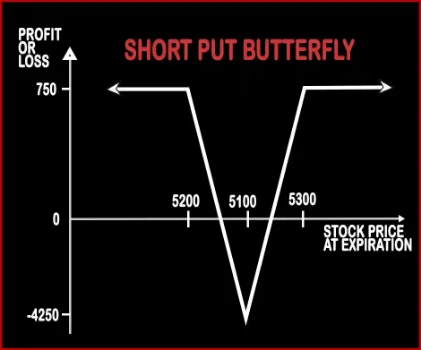

SHORT PUT BUTTERFLY

Short Put Butterfly Option Strategy

In Short Put Butterfly strategy, a trader is neutral in nature and expects the market to remain range bound in the near future. A trader will buy 2 ATM Put Options; sell 1 ITM & 1 OTM Put Options. Here risk and returns both are limited.

Risk: Limited

Reward: Limited

Suppose NIFTY is trading at 5200 odd points. Mr. X is bearish on volatility and expects the market to move upwards gradually at a very slow pace. He will implement Short Put Butterfly Strategy. He will buy two 5200 ATM Put Options at a premium of Rs.85, sell one 5100 NIFTY OTM Put Option for a premium of Rs.50 & shorts one 5300 NIFTY ITM Put Option for a premium of Rs.135.

Case 1: At expiry if NIFTY closes at 5000 level, then Mr. X will make a profit of Rs.750. [{((200-85)*2) - (100-50) - (300-135)}*50]

Case 2: At expiry if NIFTY closes at 5200 level, then Mr. X will make a loss of Rs.4250. [{(50)-(85*2)-(100-135)}*50]

Case 3: At expiry if NIFTY closes at 5400 level, then Mr. X will make a profit of Rs.750. [(50) - (85*2) +(135)*50]

Comments for SHORT PUT BUTTERFLY

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments