- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

IRON CONDORS

Iron Condors Option Strategy

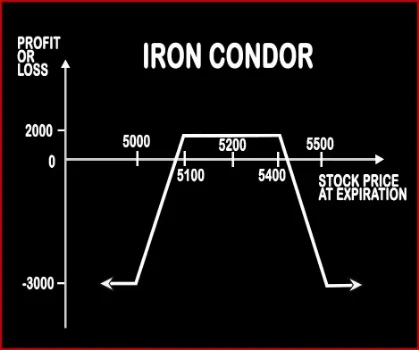

Iron Condor is a neutral trading strategy. A trader tries to make profit from low volatility in the price of the underlying asset. This strategy will be better understood if you recall ‘Bull Put Spread’ & ‘Bear Call Spread’. A trader will buy one Deep OTM Put Option and sell one OTM Put Option,. He will also sell one OTM Call Option and buy one Deep OTM Call Option.

Risk: Limited

Reward: Limited

Suppose NIFTY is trading at 5200 odd points, Mr. X is bearish on volatility and neutral on market. He will sell one 5400 NIFTY OTM Call Option for a premium of Rs.25, buy one 5500 NIFTY Deep OTM Call Option at a premium of Rs.10, sell one 5100 NIFTY OTM Put Option for a premium of Rs.50, buy one 5000 Deep OTM Put Option at a premium of Rs.25. Lot size of NIFTY is 50. His account will get credited by Rs.2000. [{(25+50)-(10+25)}*50]

Case 1: At expiry if NIFTY closes at 4800, then Mr. X will incur a loss of Rs.3000. [{(25) – (10) – (300-50) + (200-25)}*50]

Case 2: At expiry if NIFTY closes at 5300, then Mr. X gets to keep the premium amount that was credited at the time of entering the positions i.e. Rs.2000.

Case 3: At expiry if NIFTY closes at 5700, then Mr. X will incur a loss of Rs.3000. [{(200-10) – (300-25) + (50) – (25)}*50]

Comments for IRON CONDORS

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments