- SHORT STRANGLE

- LONG STRADDLE

- THE COLLAR

- SHORT PUT BUTTERFLY

- LONG PUT LADDER

- STRAP

- COVERED COMBINATION

- BEAR CALL SPREAD

- LONG STRANGLE

- SYNTHETIC LONG CALL

- IRON CONDORS

- RISK REVERSAL

- SHORT STRADDLE

- RATIO PUT SPREAD

- LONG GUTS

- SHORT CALL

- PUT BACKSPREAD

- PROTECTIVE CALL

- LONG CALL CONDOR SPREAD

- SHORT PUT LADDER

- COVERED PUT

- LONG COMBO

- PROTECTIVE COLLAR

- MARRIED PUT

- CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY

- DIAGONAL BULL CALL SPREAD

- REVERSE IRON CONDOR

- LONG CALL BUTTERFLY

- CHRISTMAS TREE SPREAD WITH PUT OPTION

- RATIO CALL WRITE

- STOCK REPAIR

- BULL CALL SPREAD

- BEAR PUT SPREAD

- PROTECTIVE PUT

- SHORT PUT

- LONG PUT

- BULL PUT SPREAD

- LONG CALL LADDER

- SHORT CALL CONDOR SPREAD

- SHORT CALL BUTTERFLY

- SHORT GUTS

- LONG CALL

- STRIP

- IRON BUTTERFLY

- REVERSE IRON BUTTERFLY

- RATIO PUT WRITE

- SHORT CALL LADDER

- RATIO CALL SPREAD

- NEUTRAL CALENDAR SPREAD

- DIAGONAL BEAR PUT SPREAD

- COVERED CALL

- CALL BACKSPREAD

- LONG PUT BUTTERFLY

- BULL CALENDER SPREAD

Compare Strategies

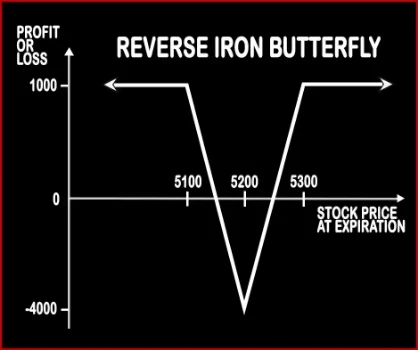

REVERSE IRON BUTTERFLY

Reverse Iron Butterfly Option Strategy

Reverse Iron Butterfly as the name suggests is the opposite of Iron Butterfly. In Reverse Iron Butterfly, a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. Here a trader will buy 1 ATM Call Option, sell 1 OTM Call Option, buy 1 ATM Put Option, sell 1 OTM Put Option. This strategy also bags limited profit with limited risk.

Risk: Limited

Reward: Limited

Suppose NIFTY is trading around 5200 odd points and Mr. X is bullish on the market volatility. He will sell 15300 OTM Call Option for a premium of Rs.55, buy 15200 ATM Call Option at a premium of Rs.100, buy 15200 ATM Put Option at a premium of Rs.85, sell 1 5100 OTM Put Option for a premium of Rs.50. Lot size of NIFTY is 50. His net investment will be Rs.4000. [{(50+55)-(100+85)}*50]

Case 1: At expiry if NIFTY closes at 5000, then Mr. X will make a profit of Rs.1000. [{(55) – (100) + (200-85)– (100-50)}*50]

Case 2: At expiry if NIFTY closes at 5200 levels, then Mr. X lose the premium amount that was paid at the time of entering the positions i.e. Rs.4000.

Case 3: At expiry if NIFTY closes at 5400, then Mr. X will make a profit of Rs.1000. [{(200-100) – (100-55) – (85) + (50)}*50]

Comments for REVERSE IRON BUTTERFLY

Options Trading Strategies

Bullish Strategies

Bearish Strategies

Neutral Strategies

- LONG STRADDLE

- SHORT STRADDLE

- LONG STRANGLE

- SHORT STRANGLE

- LONG CALL BUTTERFLY

- SHORT CALL BUTTERFLY

- LONG PUT BUTTERFLY

- SHORT PUT BUTTERFLY

- STRAP

- STRIP

- LONG CALL LADDER

- LONG PUT LADDER

- SHORT CALL LADDER

- SHORT PUT LADDER

- LONG CALL CONDOR SPREAD

- SHORT CALL CONDOR SPREAD

- NEUTRAL CALENDAR SPREAD

- LONG GUTS

- SHORT GUTS

- RATIO CALL SPREAD

- RATIO CALL WRITE

- RATIO PUT SPREAD

- RATIO PUT WRITE

- IRON CONDORS

- IRON BUTTERFLY

- REVERSE IRON CONDOR

- REVERSE IRON BUTTERFLY

- PROTECTIVE COLLAR

0 comments