Compare Strategies

| RATIO PUT SPREAD | DIAGONAL BULL CALL SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

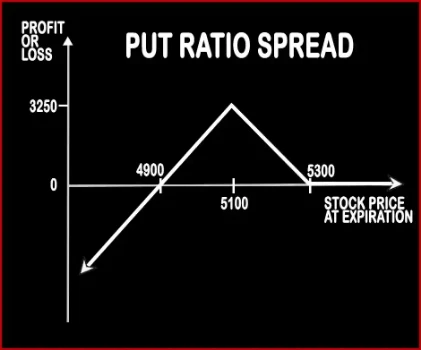

Ratio Put Spread Option StrategyThis strategy involves buying ITM Puts and simultaneously selling OTM Puts, double the number of ITM Puts. This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited. |

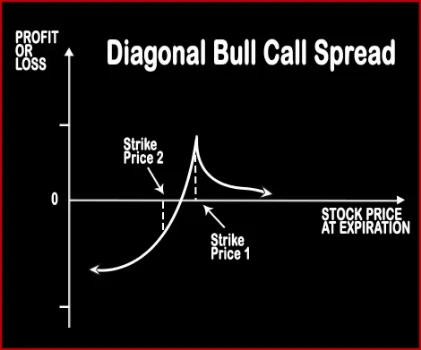

Diagonal Bull Call Spread Option StrategyThis strategy is implemented by a trader when he is neutral – moderately bullish in the near-month contract and bullish in the mid-month contract. It involves sale of 1 Near-Month OTM Call Option and buying of 1 Mid Month ITM Call Option. Risk:

|

RATIO PUT SPREAD Vs DIAGONAL BULL CALL SPREAD - Details

| RATIO PUT SPREAD | DIAGONAL BULL CALL SPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) |

RATIO PUT SPREAD Vs DIAGONAL BULL CALL SPREAD - When & How to use ?

| RATIO PUT SPREAD | DIAGONAL BULL CALL SPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. | |

| Action | Buy 1 ITM Put, Sell 2 OTM Puts | Buy 1 Long-Term ITM Call Sell 1 Near-Term OTM Call |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) |

RATIO PUT SPREAD Vs DIAGONAL BULL CALL SPREAD - Risk & Reward

| RATIO PUT SPREAD | DIAGONAL BULL CALL SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Long Put - Strike Price of Short Put + Net Premium Received - Commissions Paid | |

| Maximum Loss Scenario | Strike Price of Short - Price of Underlying - Max Profit + Commissions Paid | |

| Risk | Unlimited | Limited |

| Reward | Limited | Limited |

RATIO PUT SPREAD Vs DIAGONAL BULL CALL SPREAD - Strategy Pros & Cons

| RATIO PUT SPREAD | DIAGONAL BULL CALL SPREAD | |

|---|---|---|

| Similar Strategies | Short Straddle (Sell Straddle), Short Strangle (Sell Strangle) | Bull Put Spread |

| Disadvantage | • Unlimited potential risk. • Limited profit. | |

| Advantages | • Directional strategy so that there is either no upside or downside risk. • Able to profit even if trader is neutral on the market. • Higher probability of profit. |