Compare Strategies

| SYNTHETIC LONG CALL | STOCK REPAIR | |

|---|---|---|

|

|

|

| About Strategy |

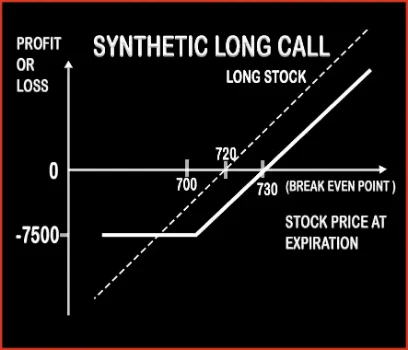

Synthetic Long Call Option StrategyA trader is bullish in nature for short term, but also fearful about the downside risk associated with it. Here, a trader wants to hold an underlying asset either in physical form like in case of commodities or demat (electronic) form in case of stocks. But he is always exposed to downside risk and in order to mitigate his losses, |

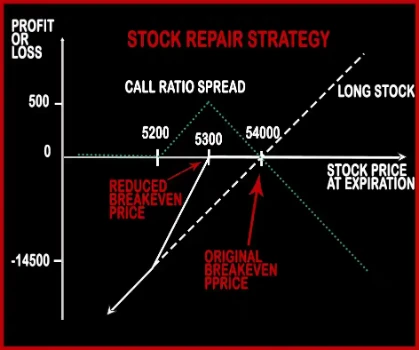

Stock Repair Option StrategyStock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. Suppose Mr. X has .. |

SYNTHETIC LONG CALL Vs STOCK REPAIR - Details

| SYNTHETIC LONG CALL | STOCK REPAIR | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) |

| Number Of Positions | 2 | 3 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | When Price of Underlying > Purchase Price of Underlying + Premium Paid | Unlimited |

| Risk Profile | Limited (Maximum loss happens when the price of instrument move above from the strike price of put) | Limited |

| Breakeven Point | Underlying Price + Put Premium |

SYNTHETIC LONG CALL Vs STOCK REPAIR - When & How to use ?

| SYNTHETIC LONG CALL | STOCK REPAIR | |

|---|---|---|

| Market View | Bullish | Bullish |

| When to use? | A trader is bullish in nature for short term, but also fearful about the downside risk associated with it. | Stock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. |

| Action | Buy 1 ATM Put or OTM Put | Buy 1 ATM Call, Sell 2 OTM Calls |

| Breakeven Point | Underlying Price + Put Premium |

SYNTHETIC LONG CALL Vs STOCK REPAIR - Risk & Reward

| SYNTHETIC LONG CALL | STOCK REPAIR | |

|---|---|---|

| Maximum Profit Scenario | Current Price - Purchase Price - Premium Paid | |

| Maximum Loss Scenario | Premium Paid | |

| Risk | Limited | Limited |

| Reward | Unlimited | Unlimited |

SYNTHETIC LONG CALL Vs STOCK REPAIR - Strategy Pros & Cons

| SYNTHETIC LONG CALL | STOCK REPAIR | |

|---|---|---|

| Similar Strategies | Protective Put, Long Call | |

| Disadvantage | •Chances of loss if the underlying goes down. •Incur losses if option is exercised. | • Management required with all the positions. • Additional loss due to continuous decline in shares as downside risk remains unchanged. |

| Advantages | •Limited risk, unlimited profit. •Protection to your long-term holdings. • Limited loss to the to the premium paid for Put option. | • This strategy creates an opportunity to recover losses by lowering our breakeven. • No margin required. • No additional downside risk and costs nothing to put on. |