Compare Strategies

| SYNTHETIC LONG CALL | SHORT PUT | |

|---|---|---|

|

|

|

| About Strategy |

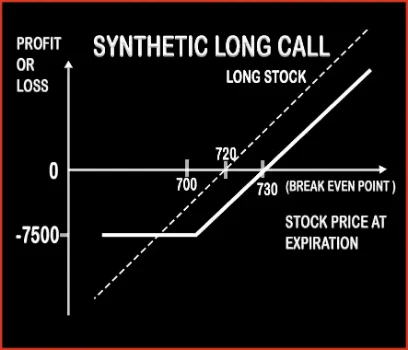

Synthetic Long Call Option StrategyA trader is bullish in nature for short term, but also fearful about the downside risk associated with it. Here, a trader wants to hold an underlying asset either in physical form like in case of commodities or demat (electronic) form in case of stocks. But he is always exposed to downside risk and in order to mitigate his losses, |

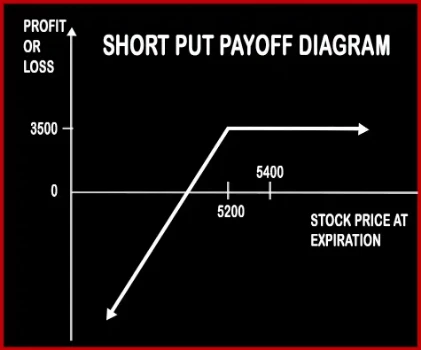

Short Put Option StrategyA trader will short put if he is bullish in nature and expects the underlying asset not to fall below a certain level. Risk: Losses will be potentially unlimited if the stock skyrockets above the strike price of put. |

SYNTHETIC LONG CALL Vs SHORT PUT - Details

| SYNTHETIC LONG CALL | SHORT PUT | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 2 | 1 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | When Price of Underlying > Purchase Price of Underlying + Premium Paid | Limited |

| Risk Profile | Limited (Maximum loss happens when the price of instrument move above from the strike price of put) | Unlimited |

| Breakeven Point | Underlying Price + Put Premium | Strike Price - Premium |

SYNTHETIC LONG CALL Vs SHORT PUT - When & How to use ?

| SYNTHETIC LONG CALL | SHORT PUT | |

|---|---|---|

| Market View | Bullish | Bullish |

| When to use? | A trader is bullish in nature for short term, but also fearful about the downside risk associated with it. | This strategy works well when you're Bullish that the price of the underlying will not fall beyond a certain level. |

| Action | Buy 1 ATM Put or OTM Put | Sell Put Option |

| Breakeven Point | Underlying Price + Put Premium | Strike Price - Premium |

SYNTHETIC LONG CALL Vs SHORT PUT - Risk & Reward

| SYNTHETIC LONG CALL | SHORT PUT | |

|---|---|---|

| Maximum Profit Scenario | Current Price - Purchase Price - Premium Paid | Premium received in your account when you sell the Put Option. |

| Maximum Loss Scenario | Premium Paid | Unlimited (When the price of the underlying falls.) |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Limited |

SYNTHETIC LONG CALL Vs SHORT PUT - Strategy Pros & Cons

| SYNTHETIC LONG CALL | SHORT PUT | |

|---|---|---|

| Similar Strategies | Protective Put, Long Call | Bull Put Spread, Short Starddle |

| Disadvantage | •Chances of loss if the underlying goes down. •Incur losses if option is exercised. | • Unlimited risk. • Huge losses if the price of the underlying stock falls steeply. |

| Advantages | •Limited risk, unlimited profit. •Protection to your long-term holdings. • Limited loss to the to the premium paid for Put option. | • Benefit from time decay. • Less capital required than buying the stock outright. • Profit when underlying stock price rise, move sideways or drop by a relatively small account. |