Compare Strategies

| LONG PUT | PROTECTIVE CALL | |

|---|---|---|

|

|

|

| About Strategy |

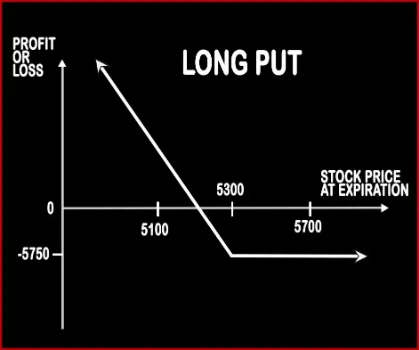

Long Put Option StrategyThis strategy is implemented by buying 1 Put Option i.e. a single position, when the person is bearish on the market and expects the market to move downwards in the near future. |

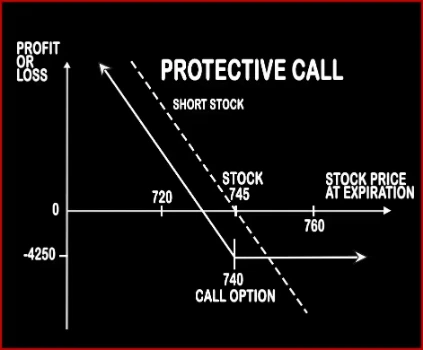

Protective Call Option StrategyThis strategy is simply the reversal of the Synthetic Call Strategy. This strategy is implemented when a trader is bearish on the market and expects to go down. Trader will short underlying stock in the cash market and buy either an ATM Call Option or OTM Call Option. The Call Option is bought to protect / hedge the upside risk on the short position. The .. |

LONG PUT Vs PROTECTIVE CALL - Details

| LONG PUT | PROTECTIVE CALL | |

|---|---|---|

| Market View | Bearish | Bearish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 1 | 1 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Unlimited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Strike Price of Long Put - Premium Paid | Sale Price of Underlying + Premium Paid |

LONG PUT Vs PROTECTIVE CALL - When & How to use ?

| LONG PUT | PROTECTIVE CALL | |

|---|---|---|

| Market View | Bearish | Bearish |

| When to use? | A long put option strategy works well when you're expecting the underlying asset to sharply decline or be volatile in near future. | This strategy is implemented when a trader is bearish on the market and expects to go down. |

| Action | Buy Put Option | Buy 1 ATM Call |

| Breakeven Point | Strike Price of Long Put - Premium Paid | Sale Price of Underlying + Premium Paid |

LONG PUT Vs PROTECTIVE CALL - Risk & Reward

| LONG PUT | PROTECTIVE CALL | |

|---|---|---|

| Maximum Profit Scenario | Profit = Strike Price of Long Put - Premium Paid | Sale Price of Underlying - Price of Underlying - Premium Paid |

| Maximum Loss Scenario | Max Loss = Premium Paid + Commissions Paid | Premium Paid + Call Strike Price - Sale Price of Underlying + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Unlimited | Unlimited |

LONG PUT Vs PROTECTIVE CALL - Strategy Pros & Cons

| LONG PUT | PROTECTIVE CALL | |

|---|---|---|

| Similar Strategies | Protective Call, Short Put | Put Backspread, Long Put |

| Disadvantage | • 100% loss if strike price, expiration dates or underlying stocks are badly chosen. • Time decay. | • Profitable when market moves as expected. • Not good for beginners. |

| Advantages | • Limited risk to the premium paid. • Less capital investment and more profit. • Unlimited profit potential with limited risk. | • Limited risk if the market moves in opposite direction as expected. • Allows you to keep open a profitable position to make further profits. • Unlimited profit potential. |