Compare Strategies

| CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY | STOCK REPAIR | |

|---|---|---|

|

|

|

| About Strategy |

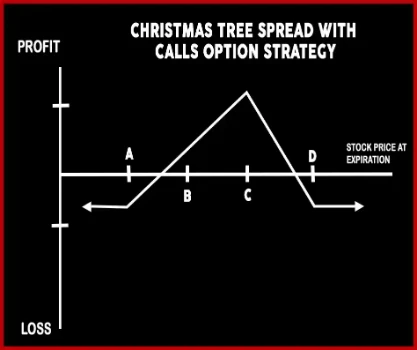

Christmas Tree Spread with Call Option StrategyThis Strategy is an advance option strategy that consists of three legs and six total options. In this strategy buying one call at strike price A, skipping strike price B, writes three calls at strike price C, and buying two calls at strike price D for same expiration dates for neutral to bullish forecast. An investor used this strategy to potential retur |

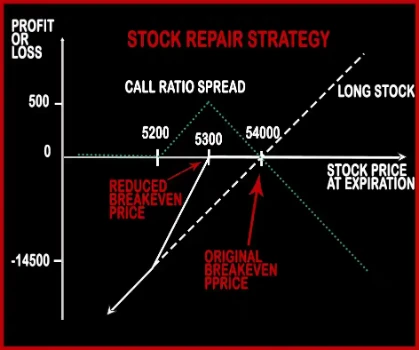

Stock Repair Option StrategyStock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. Suppose Mr. X has .. |

CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY Vs STOCK REPAIR - Details

| CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY | STOCK REPAIR | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) |

| Number Of Positions | 4 | 3 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lowest strike prices + premium paid – the half premium. |

CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY Vs STOCK REPAIR - When & How to use ?

| CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY | STOCK REPAIR | |

|---|---|---|

| Market View | Bullish | Bullish |

| When to use? | This Strategy is used when an investor wants potential returns. | Stock Repair Strategy is used to cover up for losses made on long stock position. After the long position suffered losses on stock price fall, a trader will implement this strategy in order to bring down the breakeven price and capping his further losses thereby increasing his probability of loss recovery. |

| Action | • Buy 1 call , • Sell 3 calls, • Buy 2 calls | Buy 1 ATM Call, Sell 2 OTM Calls |

| Breakeven Point | Lowest strike prices + premium paid – the half premium. |

CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY Vs STOCK REPAIR - Risk & Reward

| CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY | STOCK REPAIR | |

|---|---|---|

| Maximum Profit Scenario | Equal middle strike price – lower strike price – the premium | |

| Maximum Loss Scenario | Net Debit paid for the strategy. | |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY Vs STOCK REPAIR - Strategy Pros & Cons

| CHRISTMAS TREE SPREAD WITH CALL OPTION STRATEGY | STOCK REPAIR | |

|---|---|---|

| Similar Strategies | CHRISTMAS TREE SPREAD WITH PUT OPTION | |

| Disadvantage | • Potential profit is lower or limited. | • Management required with all the positions. • Additional loss due to continuous decline in shares as downside risk remains unchanged. |

| Advantages | • The potential of loss is limited. | • This strategy creates an opportunity to recover losses by lowering our breakeven. • No margin required. • No additional downside risk and costs nothing to put on. |