Compare Strategies

| SHORT PUT LADDER | SHORT GUTS | |

|---|---|---|

|

|

|

| About Strategy |

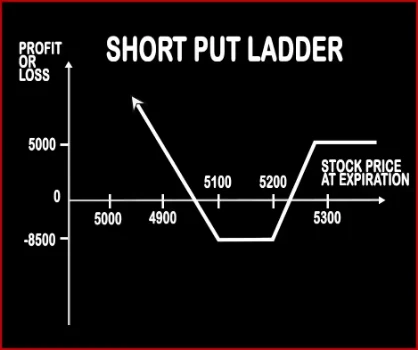

Short Put Ladder Option StrategyThis strategy is implemented when a trader is slightly bearish on the market. A trader is required to be bullish over the volatility in the market. It involves sale of an ITM Put Option and buying of 1 ATM & 1 OTM Put Options. However, the risk associated with this strategy is limited.

|

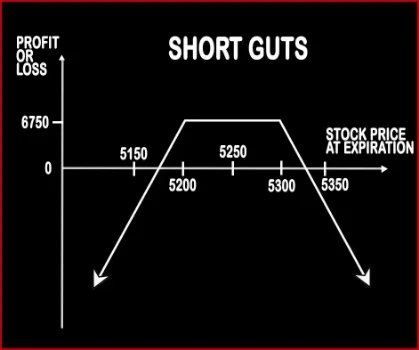

Short Guts Option StrategyThis strategy is implemented by a trader when he is neutral on the movements and bearish on volatility i.e. he expects the stock to be range bound in the near future. This strategy involves sale of 1 ITM Call Option and 1 ITM Put Option. This strategy can be called as Credit Spread since his account is credited at the time of entering in the positions. < .. |

SHORT PUT LADDER Vs SHORT GUTS - Details

| SHORT PUT LADDER | SHORT GUTS | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Put - Net Premium Received Lower Breakeven Point = Total Strike Prices of Long Puts - Strike Price of Short Put + Net Premium Received | Upper Breakeven Point = Net Premium Received + Strike Price of Short Call, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

SHORT PUT LADDER Vs SHORT GUTS - When & How to use ?

| SHORT PUT LADDER | SHORT GUTS | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is implemented when a trader is slightly bearish on the market. | This strategy is implemented by a trader when he is neutral on the movements and bearish on volatility i.e. he expects the stock to be range bound in the near future. |

| Action | Sell ITM Put Option, Buying 1 ATM & 1 OTM Put Option. | Sell 1 ITM Call, Sell 1 ITM Put |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Put - Net Premium Received Lower Breakeven Point = Total Strike Prices of Long Puts - Strike Price of Short Put + Net Premium Received | Upper Breakeven Point = Net Premium Received + Strike Price of Short Call, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

SHORT PUT LADDER Vs SHORT GUTS - Risk & Reward

| SHORT PUT LADDER | SHORT GUTS | |

|---|---|---|

| Maximum Profit Scenario | When Price of Underlying < Total Strike Prices of Long Puts - Strike Price of Short Put + Net Premium Received | Net Premium Received + Strike Price of Short Put - Strike Price of Short Call - Commissions Paid |

| Maximum Loss Scenario | Strike Price of Short Put - Strike Price of Higher Strike Long Put - Net Premium Received + Commissions Paid | Price of Underlying - Strike Price of Short Call - Net Premium Received OR Strike Price of Short Put - Price of Underlying - Net Premium Received + Commissions Paid |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Limited |

SHORT PUT LADDER Vs SHORT GUTS - Strategy Pros & Cons

| SHORT PUT LADDER | SHORT GUTS | |

|---|---|---|

| Similar Strategies | Strap, Strip | Short Strangle (Sell Strangle), Short Straddle (Sell Straddle) |

| Disadvantage | • Best to use when you are confident about movement of market. • Small margin required. | • Unlimited potential loss if the underlying stock continues to move in one direction. • High margin required. |

| Advantages | • When there is surge in implied volatility, this strategy can give more profit. • Unlimited downside profit. • Limited risk and unlimited reward strategy. | • Ability to profit even when underlying asset stays stagnant. • You are already paid your full profit the moment the position is put on as this is a credit spread position. • Higher chance of ending in full profit as compared to short strangle or short straddle. |