Compare Strategies

| COVERED COMBINATION | PROTECTIVE PUT | |

|---|---|---|

|

|

|

| About Strategy |

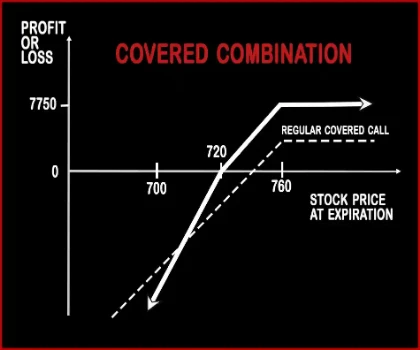

Covered Combination Option StrategyThis strategy involves selling OTM Call & Put Options and buying the underlying asset in either cash or futures market. It is also known as Covered Strangle as the profits are capped and risk is potentially unlimited. Risk: Un |

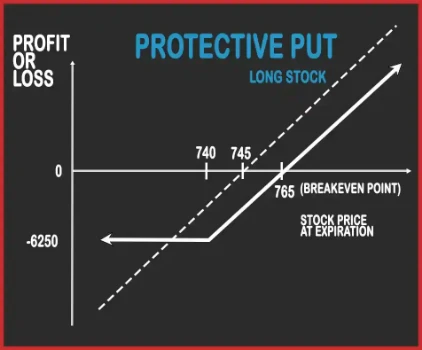

Protective Put Option StrategyProtective Put Strategy is a hedging strategy where trader guards himself from the downside risk. This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. He will buy one ATM Put Option to hedge his position. Now, if the underlying asset moves either up or down, the trader is in a safe position.

|

COVERED COMBINATION Vs PROTECTIVE PUT - Details

| COVERED COMBINATION | PROTECTIVE PUT | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | PE (Put Option) |

| Number Of Positions | 2 | 1 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | (Purchase Price of Underlying + Strike Price of Short Put - Net Premium Received) / 2 | Purchase Price of Underlying + Premium Paid |

COVERED COMBINATION Vs PROTECTIVE PUT - When & How to use ?

| COVERED COMBINATION | PROTECTIVE PUT | |

|---|---|---|

| Market View | Bullish | Bullish |

| When to use? | This strategy is mainly suited for investors who are moderately bullish on a stock and are comfortable with increasing their position in the event of a price decline. | This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. |

| Action | Sell 1 OTM Call, Sell 1 OTM Put | Buy 1 ATM Put |

| Breakeven Point | (Purchase Price of Underlying + Strike Price of Short Put - Net Premium Received) / 2 | Purchase Price of Underlying + Premium Paid |

COVERED COMBINATION Vs PROTECTIVE PUT - Risk & Reward

| COVERED COMBINATION | PROTECTIVE PUT | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received - Commissions Paid | Price of Underlying - Purchase Price of Underlying - Premium Paid |

| Maximum Loss Scenario | Purchase Price of Underlying + Strike Price of Short Put - (2 x Price of Underlying) - Max Profit + Commissions Paid | Premium Paid + Purchase Price of Underlying - Put Strike + Commissions Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

COVERED COMBINATION Vs PROTECTIVE PUT - Strategy Pros & Cons

| COVERED COMBINATION | PROTECTIVE PUT | |

|---|---|---|

| Similar Strategies | Stock Repair Strategy | Long Call, Call Backspread |

| Disadvantage | Combinations can be profitable in sideways or rising markets. Greater combined net credit increases downside protection and potential return. | • Value of protective put position decreases as time passes • Holding period of the protective put can be affected by the timing as a result tax rate on the profit or loss from the stock can be affected. |

| Advantages | Limited Maximum Profit on the upside. Covered Combinations should only be traded on stocks that are bullish. | • Unlimited potential profit due to indefinitely rise in the underlying stock price . • This strategy allows you to hold on to your stocks while insuring against losses. • Hedging strategy, trader can guard himself from the downside risk. |