Compare Strategies

| LONG PUT | PUT BACKSPREAD | |

|---|---|---|

|

|

|

| About Strategy |

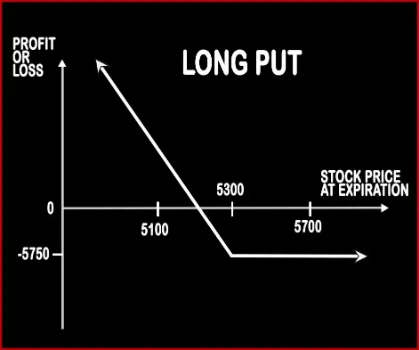

Long Put Option StrategyThis strategy is implemented by buying 1 Put Option i.e. a single position, when the person is bearish on the market and expects the market to move downwards in the near future. |

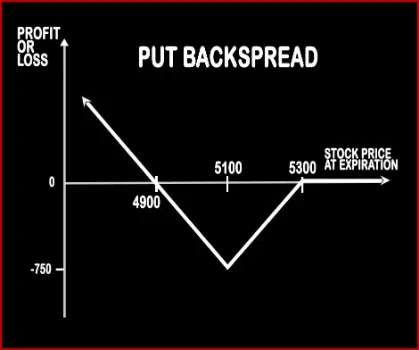

Put Backspread Option StrategyIf the trader is bearish on market and bullish in volatility, he will implement this strategy. However the trader can be neutral in nature i.e. indifferent if the market moves in either of the direction, this strategy will make profits, but uptrend will give a capped income than downtrend which will give unlimited returns. |

LONG PUT Vs PUT BACKSPREAD - Details

| LONG PUT | PUT BACKSPREAD | |

|---|---|---|

| Market View | Bearish | Bearish |

| Type (CE/PE) | PE (Put Option) | PE (Put Option) |

| Number Of Positions | 1 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Unlimited | |

| Risk Profile | Limited | |

| Breakeven Point | Strike Price of Long Put - Premium Paid |

LONG PUT Vs PUT BACKSPREAD - When & How to use ?

| LONG PUT | PUT BACKSPREAD | |

|---|---|---|

| Market View | Bearish | Bearish |

| When to use? | A long put option strategy works well when you're expecting the underlying asset to sharply decline or be volatile in near future. | |

| Action | Buy Put Option | |

| Breakeven Point | Strike Price of Long Put - Premium Paid |

LONG PUT Vs PUT BACKSPREAD - Risk & Reward

| LONG PUT | PUT BACKSPREAD | |

|---|---|---|

| Maximum Profit Scenario | Profit = Strike Price of Long Put - Premium Paid | |

| Maximum Loss Scenario | Max Loss = Premium Paid + Commissions Paid | |

| Risk | Limited | Limited |

| Reward | Unlimited | Unlimited |

LONG PUT Vs PUT BACKSPREAD - Strategy Pros & Cons

| LONG PUT | PUT BACKSPREAD | |

|---|---|---|

| Similar Strategies | Protective Call, Short Put | |

| Disadvantage | • 100% loss if strike price, expiration dates or underlying stocks are badly chosen. • Time decay. | |

| Advantages | • Limited risk to the premium paid. • Less capital investment and more profit. • Unlimited profit potential with limited risk. |