Compare Strategies

| STRIP | NEUTRAL CALENDAR SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

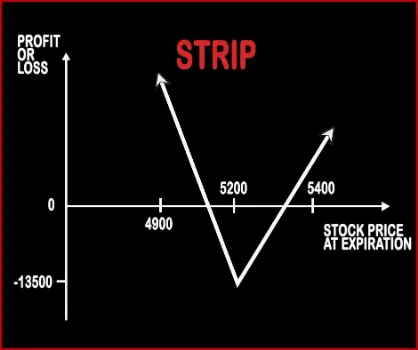

Strip Option StrategyStrip Strategy is the opposite of Strap Strategy. When a trader is bearish on the market and bullish on volatility then he will implement this strategy by buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date & underlying asset. If the prices move downwards then this strategy will make more profits compared to short straddle because of the |

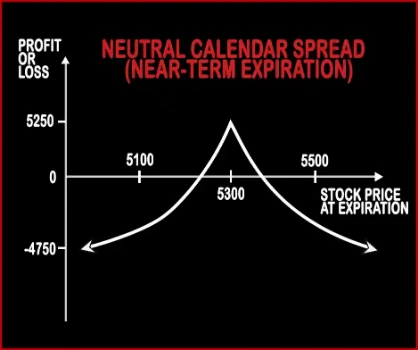

Neutral Calendar Spread Option strategyThis strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option, hence reducing the cost of purchase, with the same strike price of the same underlying asset. This strategy is used when the trader wants to make money from the .. |

STRIP Vs NEUTRAL CALENDAR SPREAD - Details

| STRIP | NEUTRAL CALENDAR SPREAD | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | - |

STRIP Vs NEUTRAL CALENDAR SPREAD - When & How to use ?

| STRIP | NEUTRAL CALENDAR SPREAD | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | When a trader is bearish on the market and bullish on volatility then he will implement this strategy. | This strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option. |

| Action | Buy 1 ATM Call, Buy 2 ATM Puts | Sell 1 Near-Term ATM Call, Buy 1 Long-Term ATM Call |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | - |

STRIP Vs NEUTRAL CALENDAR SPREAD - Risk & Reward

| STRIP | NEUTRAL CALENDAR SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Price of Underlying - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - Price of Underlying) - Net Premium Paid | Maximum Profit Limited When underlying stock price remains unchanged on expiration of the near month options. |

| Maximum Loss Scenario | Net Premium Paid + Commissions Paid | It occurs when the stock price goes down and stays down until expiration of the longer term options. |

| Risk | Limited | Limited |

| Reward | Unlimited | Limited |

STRIP Vs NEUTRAL CALENDAR SPREAD - Strategy Pros & Cons

| STRIP | NEUTRAL CALENDAR SPREAD | |

|---|---|---|

| Similar Strategies | Strap, Short Put Ladder | Long Put Butterfly, Iron Butterfly |

| Disadvantage | Expensive., The share price must change significantly to generate profit., High Bid/Offer spread can have a negative influence on the position. | • Lower profitability • Must have enough experience. |

| Advantages | Profit is generated when the share price changes in any direction., Limited loss., The profit is potentially unlimited when share prices are moving. | • Almost zero margin required. • Ability to profit from time decay, limited risk. • This strategy allows you to transform position into long position. |