Compare Strategies

| BEAR CALL SPREAD | SHORT STRANGLE | |

|---|---|---|

|

|

|

| About Strategy |

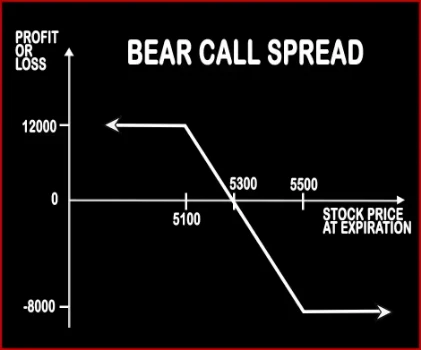

Bear Call Spread Option StrategyBear Call Spread option trading strategy is used by a trader who is bearish in nature and expects the underlying asset to dip in the near future. This strategy includes buying of an ‘Out of the Money’ Call Option and selling one ‘In the Money’ Call Option of the same underlying asset and the same expiration date. When you write a call, you receive premium thereby r |

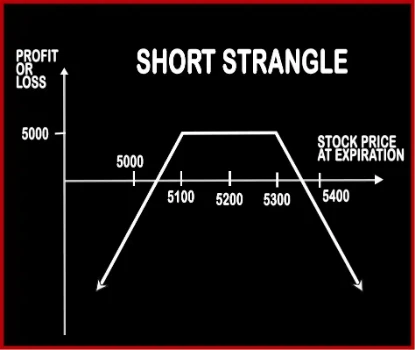

Short Strangle Option StrategyThis strategy is similar to Short Straddle; the only difference is of the strike prices at which the positions are built. Short Strangle involves selling of one OTM Call Option and selling of one OTM Put Option, of the same expiry date and same underlying asset. Here the probability of making profits is more as there is a spread between the two strike prices, and if .. |

BEAR CALL SPREAD Vs SHORT STRANGLE - Details

| BEAR CALL SPREAD | SHORT STRANGLE | |

|---|---|---|

| Market View | Bearish | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Strike Price of Short Call + Net Premium Received | Lower Break-even = Strike Price of Put - Net Premium, Upper Break-even = Strike Price of Call+ Net Premium |

BEAR CALL SPREAD Vs SHORT STRANGLE - When & How to use ?

| BEAR CALL SPREAD | SHORT STRANGLE | |

|---|---|---|

| Market View | Bearish | Neutral |

| When to use? | This strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of prime movements going against your expectations. | This strategy is perfect in a neutral market scenario when the underlying is expected to be less volatile. |

| Action | Buy OTM Call Option, Sell ITM Call Option | Sell OTM Call, Sell OTM Put |

| Breakeven Point | Strike Price of Short Call + Net Premium Received | Lower Break-even = Strike Price of Put - Net Premium, Upper Break-even = Strike Price of Call+ Net Premium |

BEAR CALL SPREAD Vs SHORT STRANGLE - Risk & Reward

| BEAR CALL SPREAD | SHORT STRANGLE | |

|---|---|---|

| Maximum Profit Scenario | Max Profit = Net Premium Received - Commissions Paid | Maximum Profit = Net Premium Received |

| Maximum Loss Scenario | Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received | Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

BEAR CALL SPREAD Vs SHORT STRANGLE - Strategy Pros & Cons

| BEAR CALL SPREAD | SHORT STRANGLE | |

|---|---|---|

| Similar Strategies | Bear Put Spread, Bull Call Spread | Short Straddle, Long Strangle |

| Disadvantage | • Limited amount of profit. • Margin requirement, more commission charges. | • Unlimited loss is associated with this strategy, not recommended for beginners. • Limited reward amount. |

| Advantages | • This strategy takes advantage of time decay. • Investors can get profit in a flat market scenario. • Investors can earn options premium income with a lower degree of risk. | • Higher chance of profitability due to selling of OTM options. • Advantage from double time decay and a contraction in volatility. • Traders can book profit when underlying asset stays within a tight trading range. |