Compare Strategies

| SHORT PUT | LONG CALL | |

|---|---|---|

|

|

|

| About Strategy |

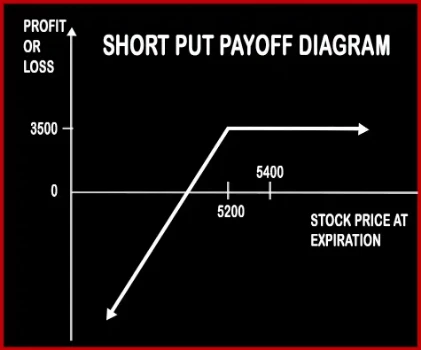

Short Put Option StrategyA trader will short put if he is bullish in nature and expects the underlying asset not to fall below a certain level. Risk: Losses will be potentially unlimited if the stock skyrockets above the strike price of put. |

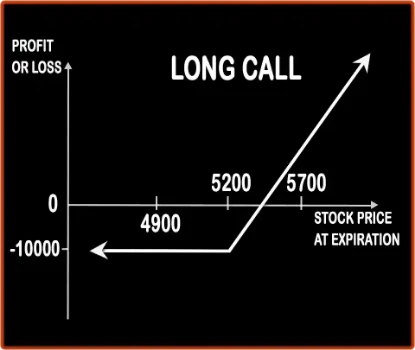

Long Call Option StrategyThis is one of the basic strategies as it involves entering into one position i.e. buying the Call Option only. Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future. Risk:

|

SHORT PUT Vs LONG CALL - Details

| SHORT PUT | LONG CALL | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 1 | 1 |

| Strategy Level | Beginners | Beginner Level |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Strike Price - Premium | Strike Price + Premium |

SHORT PUT Vs LONG CALL - When & How to use ?

| SHORT PUT | LONG CALL | |

|---|---|---|

| Market View | Bullish | Bullish (Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future.) |

| When to use? | This strategy works well when you're Bullish that the price of the underlying will not fall beyond a certain level. | This strategy work when an investor expect the underlying instrument move in upward direction. |

| Action | Sell Put Option | Buying Call option |

| Breakeven Point | Strike Price - Premium | Strike price + Premium |

SHORT PUT Vs LONG CALL - Risk & Reward

| SHORT PUT | LONG CALL | |

|---|---|---|

| Maximum Profit Scenario | Premium received in your account when you sell the Put Option. | Underlying Asset close above from the strike price on expiry. |

| Maximum Loss Scenario | Unlimited (When the price of the underlying falls.) | Premium Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

SHORT PUT Vs LONG CALL - Strategy Pros & Cons

| SHORT PUT | LONG CALL | |

|---|---|---|

| Similar Strategies | Bull Put Spread, Short Starddle | Protective Put |

| Disadvantage | • Unlimited risk. • Huge losses if the price of the underlying stock falls steeply. | • In this strategy, there is not protection against the underlying stock falling in value. • 100% loss if the strike price, expiration dates or underlying stocks are badly chosen. |

| Advantages | • Benefit from time decay. • Less capital required than buying the stock outright. • Profit when underlying stock price rise, move sideways or drop by a relatively small account. | • Less investment, more profit. • Unlimited profit with limited risk. • High leverage than simply owning the stock. |