Compare Strategies

| IRON CONDORS | LONG CALL | |

|---|---|---|

|

|

|

| About Strategy |

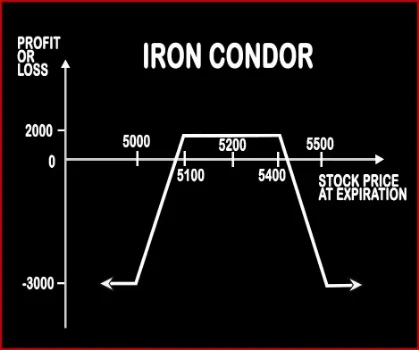

Iron Condors Option StrategyIron Condor is a neutral trading strategy. A trader tries to make profit from low volatility in the price of the underlying asset. This strategy will be better understood if you recall ‘Bull Put Spread’ & ‘Bear Call Spread’. A trader will buy one Deep OTM Put Option and sell one OTM Put Option,. He will also sell one OTM Call Option and buy one Deep OTM Call Option. |

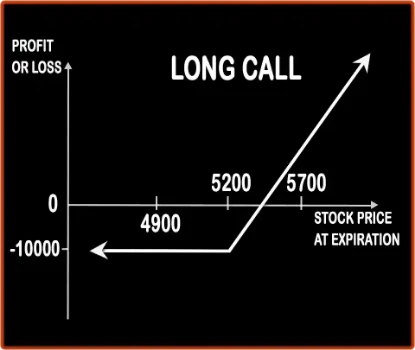

Long Call Option StrategyThis is one of the basic strategies as it involves entering into one position i.e. buying the Call Option only. Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future. Risk:

|

IRON CONDORS Vs LONG CALL - Details

| IRON CONDORS | LONG CALL | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) |

| Number Of Positions | 4 | 1 |

| Strategy Level | Advance | Beginner Level |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received | Strike Price + Premium |

IRON CONDORS Vs LONG CALL - When & How to use ?

| IRON CONDORS | LONG CALL | |

|---|---|---|

| Market View | Neutral | Bullish (Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future.) |

| When to use? | When a trader tries to make profit from low volatility in the price of the underlying asset. | This strategy work when an investor expect the underlying instrument move in upward direction. |

| Action | Sell 1 OTM Put, Buy 1 OTM Put (Lower Strike), Sell 1 OTM Call, Buy 1 OTM Call (Higher Strike) | Buying Call option |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received | Strike price + Premium |

IRON CONDORS Vs LONG CALL - Risk & Reward

| IRON CONDORS | LONG CALL | |

|---|---|---|

| Maximum Profit Scenario | Net Premium Received - Commissions Paid | Underlying Asset close above from the strike price on expiry. |

| Maximum Loss Scenario | Strike Price of Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid | Premium Paid |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

IRON CONDORS Vs LONG CALL - Strategy Pros & Cons

| IRON CONDORS | LONG CALL | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Neutral Calendar Spread | Protective Put |

| Disadvantage | • Full of risk. • Unlimited maximum loss. | • In this strategy, there is not protection against the underlying stock falling in value. • 100% loss if the strike price, expiration dates or underlying stocks are badly chosen. |

| Advantages | • Chance to gather double premium. • Sure, maximum gains on one-half the trade. • Flexible and double leverage at half price. | • Less investment, more profit. • Unlimited profit with limited risk. • High leverage than simply owning the stock. |