Compare Strategies

| LONG STRADDLE | SHORT CALL BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

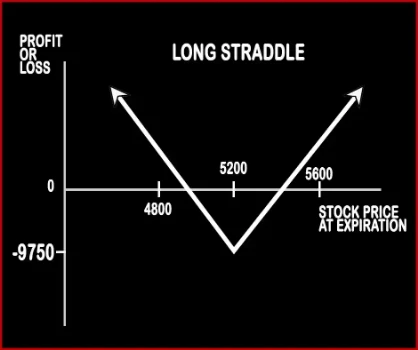

Long Straddle Option StrategyStraddle is neither bullish nor bearish strategy; it is a market neutral strategy. Here a trader wishes to take advantage of the volatility in the market. This strategy involves buying of one Call option and one Put option of the same strike price, same expiry date and of the same underlying asset. Now a trader is bound to make profits once stock moves in either direc |

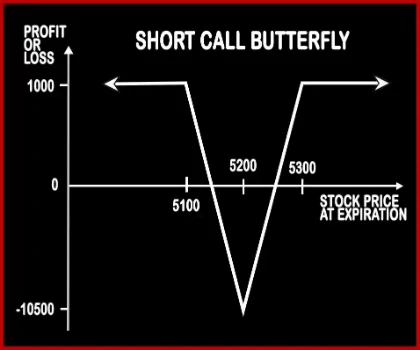

Short Call Butterfly Option StrategyThis strategy is opposite of the Long Call Butterfly Strategy, a trader expects the market to remain range bound in Long Call Butterfly, but here he expects the market to move beyond strike boundaries in Short Call Butterfly. If the trader is bullish on the market’s volatility, he will implement this strategy. Here also there should be equal distance between the .. |

LONG STRADDLE Vs SHORT CALL BUTTERFLY - Details

| LONG STRADDLE | SHORT CALL BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) |

| Number Of Positions | 2 | 4 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call + Net Premium | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium |

LONG STRADDLE Vs SHORT CALL BUTTERFLY - When & How to use ?

| LONG STRADDLE | SHORT CALL BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This options strategy is work well when and investor market view is bearish. The strategy minimizes your risk in the event of prime movements going against your expectations. | This strategy is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Action | Buy Call Option, Buy Put Option | Buy 2 ATM Call, Sell 1 ITM Call, Sell 1 OTM Call |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call + Net Premium | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium |

LONG STRADDLE Vs SHORT CALL BUTTERFLY - Risk & Reward

| LONG STRADDLE | SHORT CALL BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | Max profit is achieved when at one option is exercised. | The profit is limited to the net premium received. |

| Maximum Loss Scenario | Maximum Loss = Net Premium Paid | Higher strike price- Lower Strike Price - Net Premium |

| Risk | Limited | Limited |

| Reward | Unlimited | Limited |

LONG STRADDLE Vs SHORT CALL BUTTERFLY - Strategy Pros & Cons

| LONG STRADDLE | SHORT CALL BUTTERFLY | |

|---|---|---|

| Similar Strategies | Bear Put Spread | Long Straddle, Long Call Butterfly |

| Disadvantage | • There should be continuous movement of the stock and options price for this strategy to be profitable. • Time decay hurts long option if the strike price, expiration date or underlying stock are badly chosen. | • Limited rewards, usually offer smaller return. • Profitability depends on the significant movement of stocks and options prices. |

| Advantages | • Unlimited potential beyond the breakeven point in either direction . • Book your profit from highly volatile stocks without determining the direction. • Limited risk, more profit. | • Even if the market is highly volatile, the risk exposure remains limited. • Without any extra investment, you can receive your premium. • Able to book profits even when the price movement cannot be predicted. |