Compare Strategies

| IRON CONDORS | BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

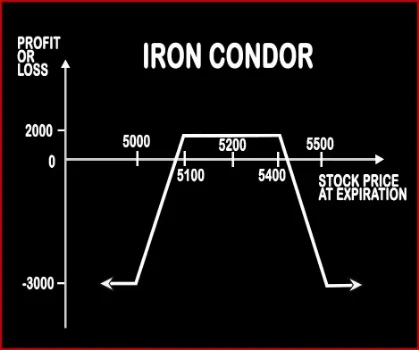

Iron Condors Option StrategyIron Condor is a neutral trading strategy. A trader tries to make profit from low volatility in the price of the underlying asset. This strategy will be better understood if you recall ‘Bull Put Spread’ & ‘Bear Call Spread’. A trader will buy one Deep OTM Put Option and sell one OTM Put Option,. He will also sell one OTM Call Option and buy one Deep OTM Call Option. |

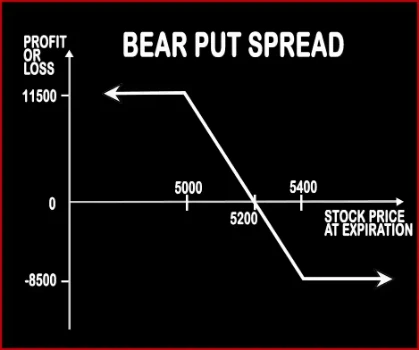

Bear Put Spread Option StrategyWhen a trader is moderately bearish on the market he can implement this strategy. Bear-Put-Spread involves buying of ITM Put Option and selling of an OTM Put Option. If prices fall, the ITM Put option starts making profits and the OTM Put option also adds to profit at a certain extent if the expiry price stays above the OTM strike. However, if it falls below the OTM .. |

IRON CONDORS Vs BEAR PUT SPREAD - Details

| IRON CONDORS | BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | PE (Put Option) |

| Number Of Positions | 4 | 2 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received | Strike Price of Long Put - Net Premium |

IRON CONDORS Vs BEAR PUT SPREAD - When & How to use ?

| IRON CONDORS | BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | When a trader tries to make profit from low volatility in the price of the underlying asset. | The bear call spread options strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of prime movements going against your expectations. |

| Action | Sell 1 OTM Put, Buy 1 OTM Put (Lower Strike), Sell 1 OTM Call, Buy 1 OTM Call (Higher Strike) | Buy ITM Put Option, Sell OTM Put Option |

| Breakeven Point | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received | Strike Price of Long Put - Net Premium |

IRON CONDORS Vs BEAR PUT SPREAD - Risk & Reward

| IRON CONDORS | BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Net Premium Received - Commissions Paid | Max Profit = Strike Price of Long Put - Strike Price of Short Put - Net Premium Paid. |

| Maximum Loss Scenario | Strike Price of Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid | Max Loss = Net Premium Paid. |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

IRON CONDORS Vs BEAR PUT SPREAD - Strategy Pros & Cons

| IRON CONDORS | BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Neutral Calendar Spread | Bear Call Spread, Bull Call Spread |

| Disadvantage | • Full of risk. • Unlimited maximum loss. | • Limited profit. • Early assignment risk. |

| Advantages | • Chance to gather double premium. • Sure, maximum gains on one-half the trade. • Flexible and double leverage at half price. | • If the strike price, expiration date or underlying stocks are rightly chosen then risk of losses would be limited to the net premium paid. • This strategy works well in declining markets. • Limited risk. |