Compare Strategies

| LONG CALL | COVERED COMBINATION | |

|---|---|---|

|

|

|

| About Strategy |

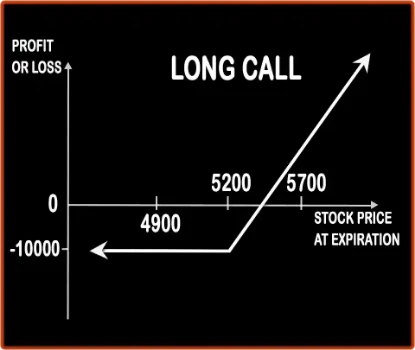

Long Call Option StrategyThis is one of the basic strategies as it involves entering into one position i.e. buying the Call Option only. Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future. Risk:

|

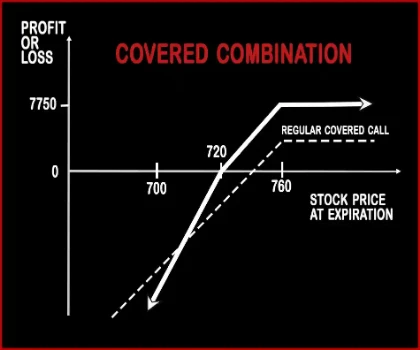

Covered Combination Option StrategyThis strategy involves selling OTM Call & Put Options and buying the underlying asset in either cash or futures market. It is also known as Covered Strangle as the profits are capped and risk is potentially unlimited. Risk: Un .. |

LONG CALL Vs COVERED COMBINATION - Details

| LONG CALL | COVERED COMBINATION | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 1 | 2 |

| Strategy Level | Beginner Level | Advance |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Strike Price + Premium | (Purchase Price of Underlying + Strike Price of Short Put - Net Premium Received) / 2 |

LONG CALL Vs COVERED COMBINATION - When & How to use ?

| LONG CALL | COVERED COMBINATION | |

|---|---|---|

| Market View | Bullish (Any investor who buys the Call Option will be bullish in nature and would be expecting the market to give decent returns in the near future.) | Bullish |

| When to use? | This strategy work when an investor expect the underlying instrument move in upward direction. | This strategy is mainly suited for investors who are moderately bullish on a stock and are comfortable with increasing their position in the event of a price decline. |

| Action | Buying Call option | Sell 1 OTM Call, Sell 1 OTM Put |

| Breakeven Point | Strike price + Premium | (Purchase Price of Underlying + Strike Price of Short Put - Net Premium Received) / 2 |

LONG CALL Vs COVERED COMBINATION - Risk & Reward

| LONG CALL | COVERED COMBINATION | |

|---|---|---|

| Maximum Profit Scenario | Underlying Asset close above from the strike price on expiry. | Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Premium Paid | Purchase Price of Underlying + Strike Price of Short Put - (2 x Price of Underlying) - Max Profit + Commissions Paid |

| Risk | Limited | Unlimited |

| Reward | Unlimited | Limited |

LONG CALL Vs COVERED COMBINATION - Strategy Pros & Cons

| LONG CALL | COVERED COMBINATION | |

|---|---|---|

| Similar Strategies | Protective Put | Stock Repair Strategy |

| Disadvantage | • In this strategy, there is not protection against the underlying stock falling in value. • 100% loss if the strike price, expiration dates or underlying stocks are badly chosen. | Combinations can be profitable in sideways or rising markets. Greater combined net credit increases downside protection and potential return. |

| Advantages | • Less investment, more profit. • Unlimited profit with limited risk. • High leverage than simply owning the stock. | Limited Maximum Profit on the upside. Covered Combinations should only be traded on stocks that are bullish. |