Compare Strategies

| LONG CALL CONDOR SPREAD | SHORT PUT BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

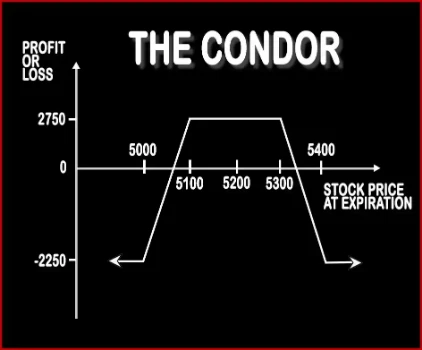

Long Call Condor Spread Option StrategyThis strategy is implemented when a trader is bearish on the volatility and expects the market to move sideways. Using Call Options of the same expiry date, he will buy one Deep ITM Call Option, sell 1 ITM Call Option, sell 1 OTM Call Option, buy 1 Deep OTM Call Option. The risk and reward both are limited due to offsetting of long and short positions. For t |

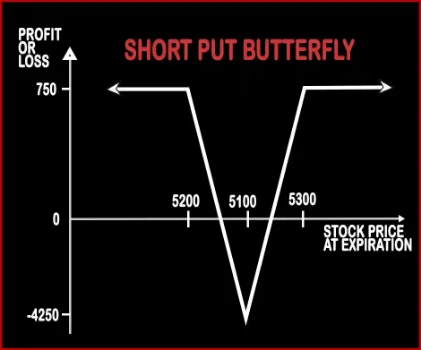

Short Put Butterfly Option StrategyIn Short Put Butterfly strategy, a trader is neutral in nature and expects the market to remain range bound in the near future. A trader will buy 2 ATM Put Options; sell 1 ITM & 1 OTM Put Options. Here risk and returns both are limited. Risk:< .. |

LONG CALL CONDOR SPREAD Vs SHORT PUT BUTTERFLY - Details

| LONG CALL CONDOR SPREAD | SHORT PUT BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 4 | 4 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Highest Strike Short Put - Net Premium Received, Lower Breakeven Point = Strike Price of Lowest Strike Short Put + Net Premium Received |

LONG CALL CONDOR SPREAD Vs SHORT PUT BUTTERFLY - When & How to use ?

| LONG CALL CONDOR SPREAD | SHORT PUT BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy works well when you expect the price of the underlying asset to be range bound in the coming days. | In Short Put Butterfly strategy, a trader is neutral in nature and expects the market to remain range bound in the near future. |

| Action | Buy Deep ITM Call Option, Buy Deep OTM Call Option, Sell ITM Call Option, Sell OTM Call Option | Sell 1 ITM Put, Buy 2 ATM Put, Sell 1 OTM Put |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Highest Strike Short Put - Net Premium Received, Lower Breakeven Point = Strike Price of Lowest Strike Short Put + Net Premium Received |

LONG CALL CONDOR SPREAD Vs SHORT PUT BUTTERFLY - Risk & Reward

| LONG CALL CONDOR SPREAD | SHORT PUT BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Lower Strike Short Call - Strike Price of Lower Strike Long Call - Net Premium Paid | Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Net Premium Paid | Strike Price of Higher Strike Short Put - Strike Price of Long Put - Net Premium Received + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

LONG CALL CONDOR SPREAD Vs SHORT PUT BUTTERFLY - Strategy Pros & Cons

| LONG CALL CONDOR SPREAD | SHORT PUT BUTTERFLY | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Short Call Condor, Short Strangle | Short Condor, Reverse Iron Condor |

| Disadvantage | • Amount of profit is comparatively low. • As this strategy has 4 legs so the brokerage cost is higher that will affect your profit. | • High risk strategy and may cause huge losses if the price of the underlying stocks falls steeply. • Higher profit is only possible when shares get close to expiration. |

| Advantages | • Capable to generate profit even if there is low volatility in the market. • This strategy is associated with limited risk and limited profit. • Wider profit zone. | • Benefits from time decay. • Traders can earn more in a rising or range bound scenario. • Benefits from a surge in volatility. |