Compare Strategies

| PROTECTIVE PUT | IRON BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

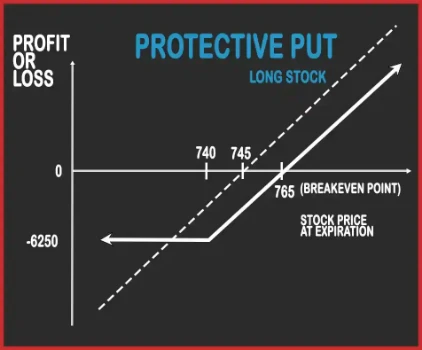

Protective Put Option StrategyProtective Put Strategy is a hedging strategy where trader guards himself from the downside risk. This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. He will buy one ATM Put Option to hedge his position. Now, if the underlying asset moves either up or down, the trader is in a safe position.

|

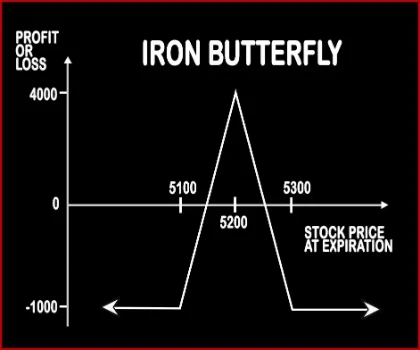

Iron Butterfly Option StrategyThis strategy is implemented when a trader is bearish on the volatility of market and neutral on the market movements. A trader will buy 1 OTM Put Option, sell 1 ATM Put Option, sell 1 ATM Call Option, buy 1 OTM Call Option. Due to offsetting of long and short positions, this strategy bags limited profit with limited risk.

|

PROTECTIVE PUT Vs IRON BUTTERFLY - Details

| PROTECTIVE PUT | IRON BUTTERFLY | |

|---|---|---|

| Market View | Bullish | Neutral |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 1 | 4 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Unlimited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Purchase Price of Underlying + Premium Paid | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

PROTECTIVE PUT Vs IRON BUTTERFLY - When & How to use ?

| PROTECTIVE PUT | IRON BUTTERFLY | |

|---|---|---|

| Market View | Bullish | Neutral |

| When to use? | This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. | This strategy is implemented when a trader is bearish on the volatility of market and neutral on the market movements. |

| Action | Buy 1 ATM Put | Buy 1 OTM Put, Sell 1 ATM Put, Sell 1 ATM Call, Buy 1 OTM Call |

| Breakeven Point | Purchase Price of Underlying + Premium Paid | Upper Breakeven Point = Strike Price of Short Call + Net Premium Received, Lower Breakeven Point = Strike Price of Short Put - Net Premium Received |

PROTECTIVE PUT Vs IRON BUTTERFLY - Risk & Reward

| PROTECTIVE PUT | IRON BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | Price of Underlying - Purchase Price of Underlying - Premium Paid | Net Premium Received - Commissions Paid |

| Maximum Loss Scenario | Premium Paid + Purchase Price of Underlying - Put Strike + Commissions Paid | Strike Price of Long Call - Strike Price of Short Call - Net Premium Received + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Unlimited | Limited |

PROTECTIVE PUT Vs IRON BUTTERFLY - Strategy Pros & Cons

| PROTECTIVE PUT | IRON BUTTERFLY | |

|---|---|---|

| Similar Strategies | Long Call, Call Backspread | Long Put Butterfly, Neutral Calendar Spread |

| Disadvantage | • Value of protective put position decreases as time passes • Holding period of the protective put can be affected by the timing as a result tax rate on the profit or loss from the stock can be affected. | • Large commissions involved. • Probability of losses are higher. |

| Advantages | • Unlimited potential profit due to indefinitely rise in the underlying stock price . • This strategy allows you to hold on to your stocks while insuring against losses. • Hedging strategy, trader can guard himself from the downside risk. | • Less amount of capital investment, steady income with low risk. • Traders can predict maximum loss and profit. • Versatile strategy, investors can transform position into bear call spread or bull put spread easily. |