Compare Strategies

| SHORT PUT BUTTERFLY | PROTECTIVE CALL | |

|---|---|---|

|

|

|

| About Strategy |

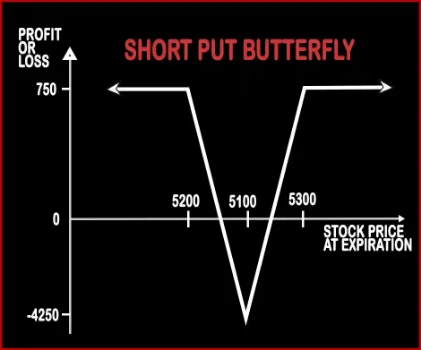

Short Put Butterfly Option StrategyIn Short Put Butterfly strategy, a trader is neutral in nature and expects the market to remain range bound in the near future. A trader will buy 2 ATM Put Options; sell 1 ITM & 1 OTM Put Options. Here risk and returns both are limited. Risk:< |

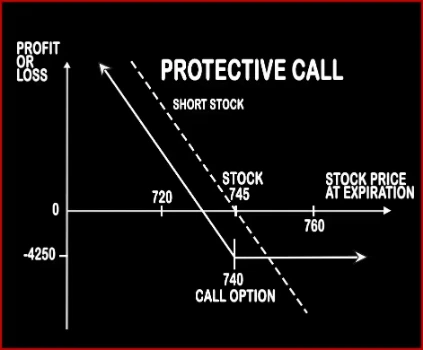

Protective Call Option StrategyThis strategy is simply the reversal of the Synthetic Call Strategy. This strategy is implemented when a trader is bearish on the market and expects to go down. Trader will short underlying stock in the cash market and buy either an ATM Call Option or OTM Call Option. The Call Option is bought to protect / hedge the upside risk on the short position. The .. |

SHORT PUT BUTTERFLY Vs PROTECTIVE CALL - Details

| SHORT PUT BUTTERFLY | PROTECTIVE CALL | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) |

| Number Of Positions | 4 | 1 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Highest Strike Short Put - Net Premium Received, Lower Breakeven Point = Strike Price of Lowest Strike Short Put + Net Premium Received | Sale Price of Underlying + Premium Paid |

SHORT PUT BUTTERFLY Vs PROTECTIVE CALL - When & How to use ?

| SHORT PUT BUTTERFLY | PROTECTIVE CALL | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | In Short Put Butterfly strategy, a trader is neutral in nature and expects the market to remain range bound in the near future. | This strategy is implemented when a trader is bearish on the market and expects to go down. |

| Action | Sell 1 ITM Put, Buy 2 ATM Put, Sell 1 OTM Put | Buy 1 ATM Call |

| Breakeven Point | Upper Breakeven Point = Strike Price of Highest Strike Short Put - Net Premium Received, Lower Breakeven Point = Strike Price of Lowest Strike Short Put + Net Premium Received | Sale Price of Underlying + Premium Paid |

SHORT PUT BUTTERFLY Vs PROTECTIVE CALL - Risk & Reward

| SHORT PUT BUTTERFLY | PROTECTIVE CALL | |

|---|---|---|

| Maximum Profit Scenario | Net Premium Received - Commissions Paid | Sale Price of Underlying - Price of Underlying - Premium Paid |

| Maximum Loss Scenario | Strike Price of Higher Strike Short Put - Strike Price of Long Put - Net Premium Received + Commissions Paid | Premium Paid + Call Strike Price - Sale Price of Underlying + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

SHORT PUT BUTTERFLY Vs PROTECTIVE CALL - Strategy Pros & Cons

| SHORT PUT BUTTERFLY | PROTECTIVE CALL | |

|---|---|---|

| Similar Strategies | Short Condor, Reverse Iron Condor | Put Backspread, Long Put |

| Disadvantage | • High risk strategy and may cause huge losses if the price of the underlying stocks falls steeply. • Higher profit is only possible when shares get close to expiration. | • Profitable when market moves as expected. • Not good for beginners. |

| Advantages | • Benefits from time decay. • Traders can earn more in a rising or range bound scenario. • Benefits from a surge in volatility. | • Limited risk if the market moves in opposite direction as expected. • Allows you to keep open a profitable position to make further profits. • Unlimited profit potential. |