Compare Strategies

| SHORT CALL BUTTERFLY | REVERSE IRON BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

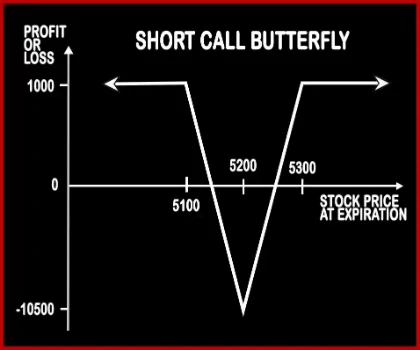

Short Call Butterfly Option StrategyThis strategy is opposite of the Long Call Butterfly Strategy, a trader expects the market to remain range bound in Long Call Butterfly, but here he expects the market to move beyond strike boundaries in Short Call Butterfly. If the trader is bullish on the market’s volatility, he will implement this strategy. Here also there should be equal distance between the |

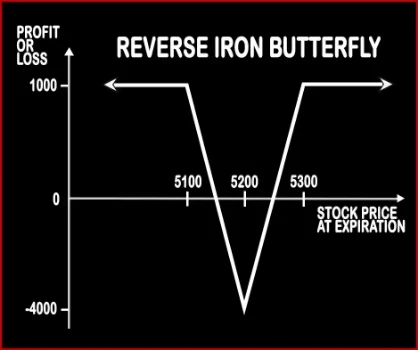

Reverse Iron Butterfly Option StrategyReverse Iron Butterfly as the name suggests is the opposite of Iron Butterfly. In Reverse Iron Butterfly, a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. Here a trader will buy 1 ATM Call Option, sell 1 OTM Call Option, buy 1 ATM Put Option, sell 1 OTM Put Option. This strategy also bags lim .. |

SHORT CALL BUTTERFLY Vs REVERSE IRON BUTTERFLY - Details

| SHORT CALL BUTTERFLY | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 4 | 4 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid |

SHORT CALL BUTTERFLY Vs REVERSE IRON BUTTERFLY - When & How to use ?

| SHORT CALL BUTTERFLY | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. | This strategy is used when a trader is bullish on volatility and expects the market to make significant move in the near future in either directions. |

| Action | Buy 2 ATM Call, Sell 1 ITM Call, Sell 1 OTM Call | Sell 1 OTM Put, Buy 1 ATM Put, Buy 1 ATM Call, Sell 1 OTM Call |

| Breakeven Point | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid, Lower Breakeven Point = Strike Price of Long Put - Net Premium Paid |

SHORT CALL BUTTERFLY Vs REVERSE IRON BUTTERFLY - Risk & Reward

| SHORT CALL BUTTERFLY | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | The profit is limited to the net premium received. | Strike Price of Short Call (or Long Put) - Strike Price of Long Call (or Short Put) - Net Premium Paid - Commissions Paid |

| Maximum Loss Scenario | Higher strike price- Lower Strike Price - Net Premium | Net Premium Paid + Commissions Paid |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

SHORT CALL BUTTERFLY Vs REVERSE IRON BUTTERFLY - Strategy Pros & Cons

| SHORT CALL BUTTERFLY | REVERSE IRON BUTTERFLY | |

|---|---|---|

| Similar Strategies | Long Straddle, Long Call Butterfly | Short Put Butterfly, Short Condor |

| Disadvantage | • Limited rewards, usually offer smaller return. • Profitability depends on the significant movement of stocks and options prices. | • Potential loss is higher than gain, complex strategy. • Not suitable for beginners. |

| Advantages | • Even if the market is highly volatile, the risk exposure remains limited. • Without any extra investment, you can receive your premium. • Able to book profits even when the price movement cannot be predicted. | • Able to profit whether stocks move in either direction up or down. • This strategy can be used by option traders who cannot use credit spreads. • Predictable maximum loss and profits, volatile strategy. |