Compare Strategies

| LONG CALL CONDOR SPREAD | STRAP | |

|---|---|---|

|

|

|

| About Strategy |

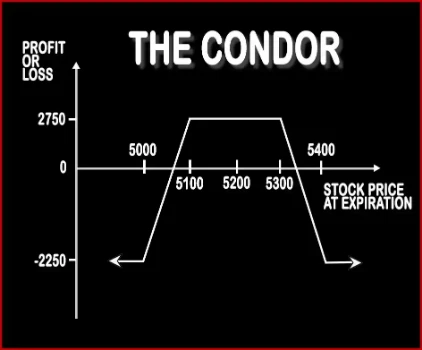

Long Call Condor Spread Option StrategyThis strategy is implemented when a trader is bearish on the volatility and expects the market to move sideways. Using Call Options of the same expiry date, he will buy one Deep ITM Call Option, sell 1 ITM Call Option, sell 1 OTM Call Option, buy 1 Deep OTM Call Option. The risk and reward both are limited due to offsetting of long and short positions. For t |

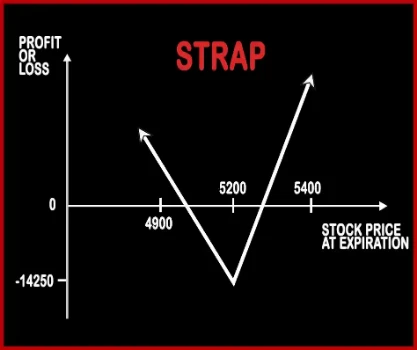

Strap Option StrategyStrap Strategy is similar to Long Straddle, the only difference is the quantity traded. A trader will buy two Call Options and one Put Options. In this strategy, a trader is very bullish on the market and volatility on upside but wants to hedge himself in case the stock doesn’t perform as per his expectations. This strategy will make more profits compared to long straddle sin .. |

LONG CALL CONDOR SPREAD Vs STRAP - Details

| LONG CALL CONDOR SPREAD | STRAP | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 4 | 3 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Profit Achieved When Price of Underlying > Strike Price of Calls/Puts + (Net Premium Paid/2) OR Price of Underlying < Strike Price of Calls/Puts - Net Premium Paid |

| Risk Profile | Limited | Max Loss Occurs When Price of Underlying = Strike Price of Calls/Puts |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | Strike Price of Calls/Puts + (Net Premium Paid/2) |

LONG CALL CONDOR SPREAD Vs STRAP - When & How to use ?

| LONG CALL CONDOR SPREAD | STRAP | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy works well when you expect the price of the underlying asset to be range bound in the coming days. | This strategy is used when the investor is bullish on the stock and expects volatility in the near future. |

| Action | Buy Deep ITM Call Option, Buy Deep OTM Call Option, Sell ITM Call Option, Sell OTM Call Option | Buy 2 ATM Call Option, Buy 1 ATM Put Option |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | Strike Price of Calls/Puts + (Net Premium Paid/2) |

LONG CALL CONDOR SPREAD Vs STRAP - Risk & Reward

| LONG CALL CONDOR SPREAD | STRAP | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Lower Strike Short Call - Strike Price of Lower Strike Long Call - Net Premium Paid | UNLIMITED |

| Maximum Loss Scenario | Net Premium Paid | Net Premium Paid |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

LONG CALL CONDOR SPREAD Vs STRAP - Strategy Pros & Cons

| LONG CALL CONDOR SPREAD | STRAP | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Short Call Condor, Short Strangle | Strip, Short Put Ladder, Short Call Ladder |

| Disadvantage | • Amount of profit is comparatively low. • As this strategy has 4 legs so the brokerage cost is higher that will affect your profit. | • To generate profit, there should be significant change in share price. • Expensive strategy. |

| Advantages | • Capable to generate profit even if there is low volatility in the market. • This strategy is associated with limited risk and limited profit. • Wider profit zone. | • Limited loss. • If share prices are moving then traders can book unlimited profit. • A trader can still book profit if the underlying falls substantially. |