Compare Strategies

| DIAGONAL BULL CALL SPREAD | PUT BACKSPREAD | |

|---|---|---|

|

|

|

| About Strategy |

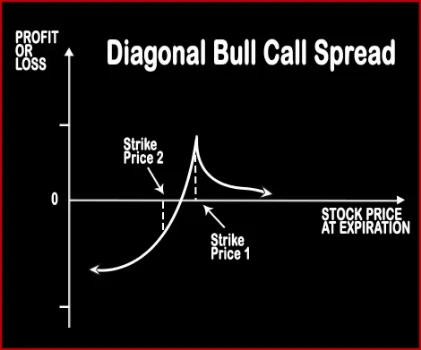

Diagonal Bull Call Spread Option StrategyThis strategy is implemented by a trader when he is neutral – moderately bullish in the near-month contract and bullish in the mid-month contract. It involves sale of 1 Near-Month OTM Call Option and buying of 1 Mid Month ITM Call Option. Risk:

|

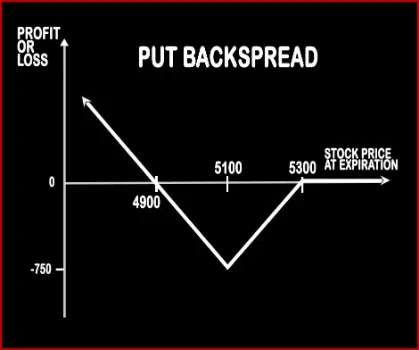

Put Backspread Option StrategyIf the trader is bearish on market and bullish in volatility, he will implement this strategy. However the trader can be neutral in nature i.e. indifferent if the market moves in either of the direction, this strategy will make profits, but uptrend will give a capped income than downtrend which will give unlimited returns. |

DIAGONAL BULL CALL SPREAD Vs PUT BACKSPREAD - Details

| DIAGONAL BULL CALL SPREAD | PUT BACKSPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | |

| Risk Profile | Limited | |

| Breakeven Point |

DIAGONAL BULL CALL SPREAD Vs PUT BACKSPREAD - When & How to use ?

| DIAGONAL BULL CALL SPREAD | PUT BACKSPREAD | |

|---|---|---|

| Market View | Bullish | Bearish |

| When to use? | ||

| Action | Buy 1 Long-Term ITM Call Sell 1 Near-Term OTM Call | |

| Breakeven Point |

DIAGONAL BULL CALL SPREAD Vs PUT BACKSPREAD - Risk & Reward

| DIAGONAL BULL CALL SPREAD | PUT BACKSPREAD | |

|---|---|---|

| Maximum Profit Scenario | ||

| Maximum Loss Scenario | ||

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

DIAGONAL BULL CALL SPREAD Vs PUT BACKSPREAD - Strategy Pros & Cons

| DIAGONAL BULL CALL SPREAD | PUT BACKSPREAD | |

|---|---|---|

| Similar Strategies | Bull Put Spread | |

| Disadvantage | ||

| Advantages |