Compare Strategies

| SHORT CALL BUTTERFLY | LONG PUT LADDER | |

|---|---|---|

|

|

|

| About Strategy |

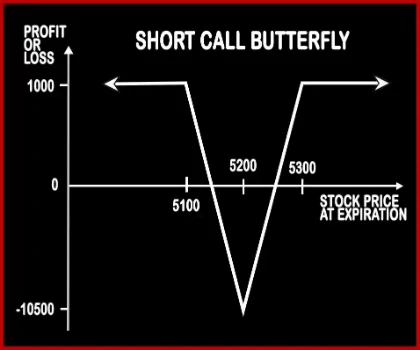

Short Call Butterfly Option StrategyThis strategy is opposite of the Long Call Butterfly Strategy, a trader expects the market to remain range bound in Long Call Butterfly, but here he expects the market to move beyond strike boundaries in Short Call Butterfly. If the trader is bullish on the market’s volatility, he will implement this strategy. Here also there should be equal distance between the |

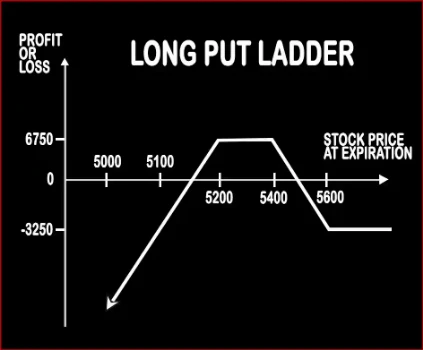

Long Put Ladder Option StrategyLong Put Ladder can be implemented when a trader is slightly bearish on the market and volatility. It involves buying of an ITM Put Option and sale of 1 ATM & 1 OTM Put Options. However, the risk associated with this strategy is unlimited and reward is limited. Risk:< .. |

SHORT CALL BUTTERFLY Vs LONG PUT LADDER - Details

| SHORT CALL BUTTERFLY | LONG PUT LADDER | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 4 | 3 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Long Put - Net Premium Paid, Lower Breakeven Point = Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid |

SHORT CALL BUTTERFLY Vs LONG PUT LADDER - When & How to use ?

| SHORT CALL BUTTERFLY | LONG PUT LADDER | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. | This Strategy can be implemented when a trader is slightly bearish on the market and volatility. |

| Action | Buy 2 ATM Call, Sell 1 ITM Call, Sell 1 OTM Call | Buy 1 ITM Put, Sell 1 ATM Put, Sell 1 OTM Put |

| Breakeven Point | Lower Break-even = Lower Strike Price + Net Premium, Upper Break-even = Higher Strike Price - Net Premium | Upper Breakeven Point = Strike Price of Long Put - Net Premium Paid, Lower Breakeven Point = Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid |

SHORT CALL BUTTERFLY Vs LONG PUT LADDER - Risk & Reward

| SHORT CALL BUTTERFLY | LONG PUT LADDER | |

|---|---|---|

| Maximum Profit Scenario | The profit is limited to the net premium received. | Strike Price of Long Put - Strike Price of Higher Strike Short Put - Net Premium Paid - Commissions Paid |

| Maximum Loss Scenario | Higher strike price- Lower Strike Price - Net Premium | When Price of Underlying < Total Strike Prices of Short Puts - Strike Price of Long Put + Net Premium Paid |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

SHORT CALL BUTTERFLY Vs LONG PUT LADDER - Strategy Pros & Cons

| SHORT CALL BUTTERFLY | LONG PUT LADDER | |

|---|---|---|

| Similar Strategies | Long Straddle, Long Call Butterfly | Short Strangle (Sell Strangle), Short Straddle (Sell Straddle) |

| Disadvantage | • Limited rewards, usually offer smaller return. • Profitability depends on the significant movement of stocks and options prices. | • Unlimited risk. • Margin required. |

| Advantages | • Even if the market is highly volatile, the risk exposure remains limited. • Without any extra investment, you can receive your premium. • Able to book profits even when the price movement cannot be predicted. | • Reduces capital outlay of bear put spread. • Wider maximum profit zone. • When there is decrease in implied volatility, this strategy can give profit. |