Compare Strategies

| NEUTRAL CALENDAR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

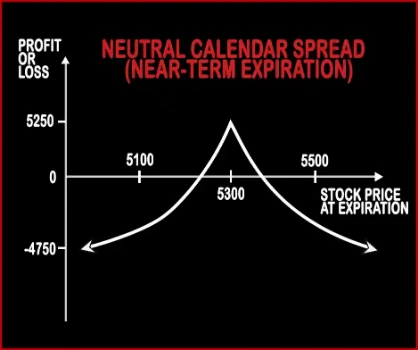

Neutral Calendar Spread Option strategyThis strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option, hence reducing the cost of purchase, with the same strike price of the same underlying asset. This strategy is used when the trader wants to make money from the |

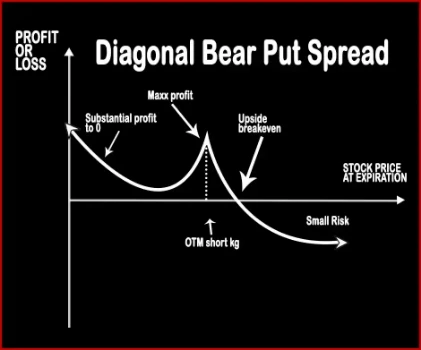

Diagonal Bear Put SpreadWhen the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk. |

NEUTRAL CALENDAR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Details

| NEUTRAL CALENDAR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | - | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

NEUTRAL CALENDAR SPREAD Vs DIAGONAL BEAR PUT SPREAD - When & How to use ?

| NEUTRAL CALENDAR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | This strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option. | When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset |

| Action | Sell 1 Near-Term ATM Call, Buy 1 Long-Term ATM Call | Sell 1 Near-Month OTM Put Option, Buy 1 Mid-Month ITM Put Option |

| Breakeven Point | - | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

NEUTRAL CALENDAR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Risk & Reward

| NEUTRAL CALENDAR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Maximum Profit Limited When underlying stock price remains unchanged on expiration of the near month options. | 'Premiums received - Initial premium to execute + Strike price - Stock Price on final month |

| Maximum Loss Scenario | It occurs when the stock price goes down and stays down until expiration of the longer term options. | When the stock trades up above the long-term put strike price. |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

NEUTRAL CALENDAR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Strategy Pros & Cons

| NEUTRAL CALENDAR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Iron Butterfly | Bear Put Spread and Bear Call Spread |

| Disadvantage | • Lower profitability • Must have enough experience. | Higher commissions due to additional trades. , Changes maximum profit potential of call or put spreads. |

| Advantages | • Almost zero margin required. • Ability to profit from time decay, limited risk. • This strategy allows you to transform position into long position. | The Risk is limited. |