Compare Strategies

| COVERED PUT | LONG CALL BUTTERFLY | |

|---|---|---|

|

|

|

| About Strategy |

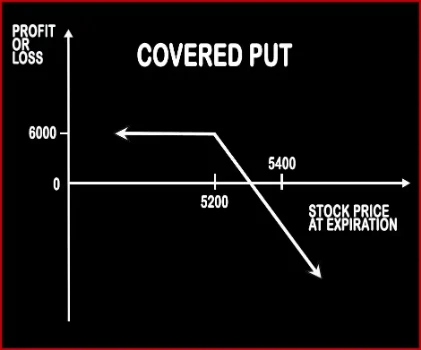

Covered Put Option StrategyThis strategy is exactly opposite to Covered Call Strategy. Here the investor is neutral or moderately bearish in nature and wants to take advantage of the price fall in the near future. The trader will short one lot of stock future. Now the trader will short ATM Put Option, the option strike price will be his exit price. If the prices rally above the strike price, the |

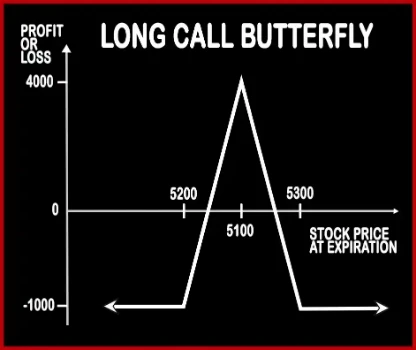

Long Call Butterfly Option StrategyA trader, who is neutral in nature and believes that there will be very low volatility i.e. expects the market to remain range bound, will implement this strategy. This strategy involves selling of 2 ATM Call Options, buying 1 ITM Call Option & buying 1 OTM Call Option of the same expiry date & same underlying asset. The difference between the strikes sho .. |

COVERED PUT Vs LONG CALL BUTTERFLY - Details

| COVERED PUT | LONG CALL BUTTERFLY | |

|---|---|---|

| Market View | Bearish | Neutral |

| Type (CE/PE) | PE (Put Option) + Underlying | CE (Call Option) |

| Number Of Positions | 2 | 4 |

| Strategy Level | Advance | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Futures Price + Premium Received | Upper Breakeven = Higher Strike Price - Net Premium, Lower Breakeven = Lower Strike Price + Net Premium |

COVERED PUT Vs LONG CALL BUTTERFLY - When & How to use ?

| COVERED PUT | LONG CALL BUTTERFLY | |

|---|---|---|

| Market View | Bearish | Neutral |

| When to use? | The Covered Put works well when the market is moderately Bearish. | This strategy should be used when you're expecting no volatility in the price of the underlying. |

| Action | Sell Underlying Sell OTM Put Option | Sell 2 ATM Call, Buy 1 ITM Call, Buy 1 OTM Call |

| Breakeven Point | Futures Price + Premium Received | Upper Breakeven = Higher Strike Price - Net Premium, Lower Breakeven = Lower Strike Price + Net Premium |

COVERED PUT Vs LONG CALL BUTTERFLY - Risk & Reward

| COVERED PUT | LONG CALL BUTTERFLY | |

|---|---|---|

| Maximum Profit Scenario | The profit happens when the price of the underlying moves above strike price of Short Put. | Adjacent strikes - Net premium debit. |

| Maximum Loss Scenario | Price of Underlying - Sale Price of Underlying - Premium Received | Net Premium Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Limited |

COVERED PUT Vs LONG CALL BUTTERFLY - Strategy Pros & Cons

| COVERED PUT | LONG CALL BUTTERFLY | |

|---|---|---|

| Similar Strategies | Bear Put Spread, Bear Call Spread | - |

| Disadvantage | • Limited profit, unlimited risk. • Trader should have enough experience before using this strategy. | • Due to limited lifespan of call options, you can lose the premium paid. • Limited profit which is bound in a narrow range between the two wing strikes. |

| Advantages | • Investors can book profit when underlying stock price drop, move sideways or rises by a small amount. • Able to generate monthly income. • Able to generate profit from fall in prices or mild increase in the prices. | • Under this strategy, a trader can book profit even when there is not volatility in the market. • Limited risks to the net premium paid. • This strategy allows you to gain more profits by investing less and limiting your losses to minimum. |