Compare Strategies

| NEUTRAL CALENDAR SPREAD | SHORT STRANGLE | |

|---|---|---|

|

|

|

| About Strategy |

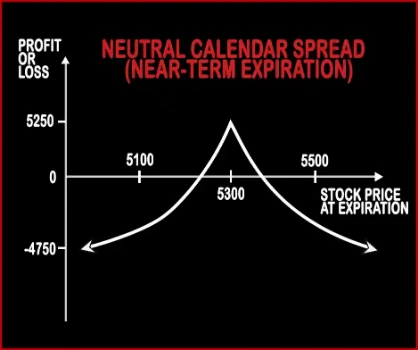

Neutral Calendar Spread Option strategyThis strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option, hence reducing the cost of purchase, with the same strike price of the same underlying asset. This strategy is used when the trader wants to make money from the |

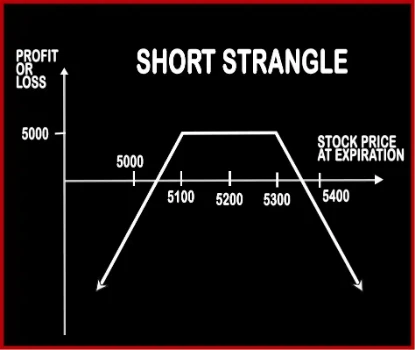

Short Strangle Option StrategyThis strategy is similar to Short Straddle; the only difference is of the strike prices at which the positions are built. Short Strangle involves selling of one OTM Call Option and selling of one OTM Put Option, of the same expiry date and same underlying asset. Here the probability of making profits is more as there is a spread between the two strike prices, and if .. |

NEUTRAL CALENDAR SPREAD Vs SHORT STRANGLE - Details

| NEUTRAL CALENDAR SPREAD | SHORT STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Unlimited |

| Breakeven Point | - | Lower Break-even = Strike Price of Put - Net Premium, Upper Break-even = Strike Price of Call+ Net Premium |

NEUTRAL CALENDAR SPREAD Vs SHORT STRANGLE - When & How to use ?

| NEUTRAL CALENDAR SPREAD | SHORT STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is implemented if the trader is neutral in the near future for say 2 months or so. This strategy involves writing of Near Month 1 ATM Call Option and buying 1 Mid Month ATM Call Option. | This strategy is perfect in a neutral market scenario when the underlying is expected to be less volatile. |

| Action | Sell 1 Near-Term ATM Call, Buy 1 Long-Term ATM Call | Sell OTM Call, Sell OTM Put |

| Breakeven Point | - | Lower Break-even = Strike Price of Put - Net Premium, Upper Break-even = Strike Price of Call+ Net Premium |

NEUTRAL CALENDAR SPREAD Vs SHORT STRANGLE - Risk & Reward

| NEUTRAL CALENDAR SPREAD | SHORT STRANGLE | |

|---|---|---|

| Maximum Profit Scenario | Maximum Profit Limited When underlying stock price remains unchanged on expiration of the near month options. | Maximum Profit = Net Premium Received |

| Maximum Loss Scenario | It occurs when the stock price goes down and stays down until expiration of the longer term options. | Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received |

| Risk | Limited | Unlimited |

| Reward | Limited | Limited |

NEUTRAL CALENDAR SPREAD Vs SHORT STRANGLE - Strategy Pros & Cons

| NEUTRAL CALENDAR SPREAD | SHORT STRANGLE | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Iron Butterfly | Short Straddle, Long Strangle |

| Disadvantage | • Lower profitability • Must have enough experience. | • Unlimited loss is associated with this strategy, not recommended for beginners. • Limited reward amount. |

| Advantages | • Almost zero margin required. • Ability to profit from time decay, limited risk. • This strategy allows you to transform position into long position. | • Higher chance of profitability due to selling of OTM options. • Advantage from double time decay and a contraction in volatility. • Traders can book profit when underlying asset stays within a tight trading range. |