Comparision ( STRIP

VS STRIP)

STRIP

STRIP

About Strategy

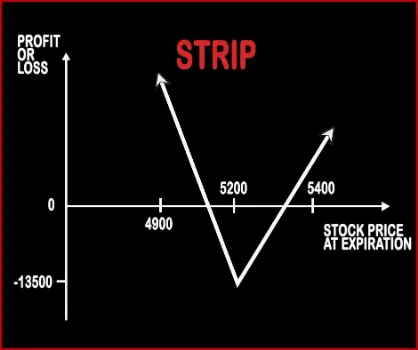

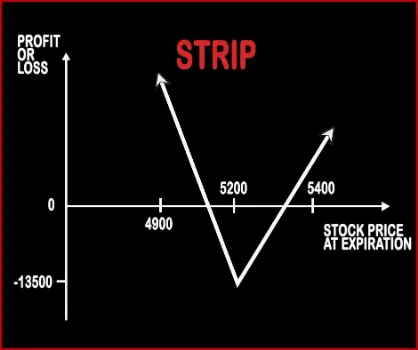

Strip Option Strategy Strip Strategy is the opposite of Strap Strategy. When a trader is bearish on the market and bullish on volatility then he will implement this strategy by buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date & underlying asset. If the prices move downwards then this strategy will make more profits compared to short straddle because of the

Strip Option Strategy Strip Strategy is the opposite of Strap Strategy. When a trader is bearish on the market and bullish on volatility then he will implement this strategy by buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date & underlying asset. If the prices move downwards then this strategy will make more profits compared to short straddle because of the ..

STRIP

STRIP

Market View

Neutral

Neutral

Type (CE/PE)

CE (Call Option) + PE (Put Option)

CE (Call Option) + PE (Put Option)

Number Of Positions

3

3

Strategy Level

Beginners

Beginners

Reward Profile

Unlimited

Unlimited

Risk Profile

Limited

Limited

Breakeven Point

Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2)

Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2)

STRIP

STRIP

Market View

Neutral

Neutral

When to use?

When a trader is bearish on the market and bullish on volatility then he will implement this strategy.

When a trader is bearish on the market and bullish on volatility then he will implement this strategy.

Action

Buy 1 ATM Call, Buy 2 ATM Puts

Buy 1 ATM Call, Buy 2 ATM Puts

Breakeven Point

Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2)

Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2)

STRIP

STRIP

Maximum Profit Scenario

Price of Underlying - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - Price of Underlying) - Net Premium Paid

Price of Underlying - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - Price of Underlying) - Net Premium Paid

Maximum Loss Scenario

Net Premium Paid + Commissions Paid

Net Premium Paid + Commissions Paid

Risk

Limited

Limited

Reward

Unlimited

Unlimited

STRIP

STRIP

Similar Strategies

Strap, Short Put Ladder

Strap, Short Put Ladder

Disadvantage

Expensive., The share price must change significantly to generate profit., High Bid/Offer spread can have a negative influence on the position.

Expensive., The share price must change significantly to generate profit., High Bid/Offer spread can have a negative influence on the position.

Advantages

Profit is generated when the share price changes in any direction., Limited loss., The profit is potentially unlimited when share prices are moving.

Profit is generated when the share price changes in any direction., Limited loss., The profit is potentially unlimited when share prices are moving.