Compare Strategies

| SHORT PUT | LONG COMBO | |

|---|---|---|

|

|

|

| About Strategy |

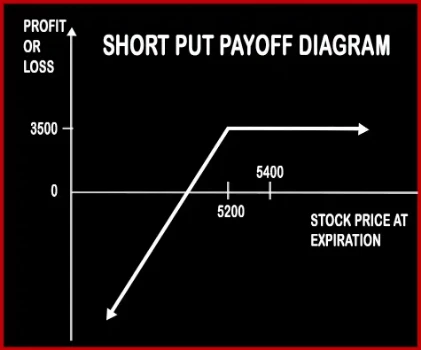

Short Put Option StrategyA trader will short put if he is bullish in nature and expects the underlying asset not to fall below a certain level. Risk: Losses will be potentially unlimited if the stock skyrockets above the strike price of put. |

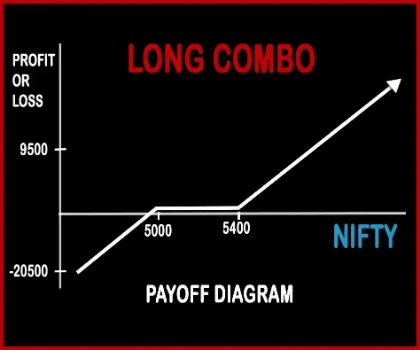

Long Combo Option StrategyLong Combo Option Trading Strategy is implemented when a trader is bullish in nature and expects the stock price to rise in the near future. Here a trader will sell one ‘Out of the Money’ Put Option and buy one ‘Out of the Money’ Call Option. This trade will require less capital to implement since the amount required to buy the call will be covered by the amount received .. |

SHORT PUT Vs LONG COMBO - Details

| SHORT PUT | LONG COMBO | |

|---|---|---|

| Market View | Bullish | Bullish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 1 | 2 |

| Strategy Level | Beginners | Advance |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Unlimited |

| Breakeven Point | Strike Price - Premium | Call Strike + Net Premium |

SHORT PUT Vs LONG COMBO - When & How to use ?

| SHORT PUT | LONG COMBO | |

|---|---|---|

| Market View | Bullish | Bullish |

| When to use? | This strategy works well when you're Bullish that the price of the underlying will not fall beyond a certain level. | This strategy is used when an investor Bullish on an underlying but don't have the required capital or the risk appetite to invest directly into it. |

| Action | Sell Put Option | Sell OTM Put Option, Buy OTM Call Option |

| Breakeven Point | Strike Price - Premium | Call Strike + Net Premium |

SHORT PUT Vs LONG COMBO - Risk & Reward

| SHORT PUT | LONG COMBO | |

|---|---|---|

| Maximum Profit Scenario | Premium received in your account when you sell the Put Option. | Underlying asset goes up and Call option exercised |

| Maximum Loss Scenario | Unlimited (When the price of the underlying falls.) | Underlying asset goes down and Put option exercised |

| Risk | Unlimited | Unlimited |

| Reward | Limited | Unlimited |

SHORT PUT Vs LONG COMBO - Strategy Pros & Cons

| SHORT PUT | LONG COMBO | |

|---|---|---|

| Similar Strategies | Bull Put Spread, Short Starddle | - |

| Disadvantage | • Unlimited risk. • Huge losses if the price of the underlying stock falls steeply. | • Losses can keep on increasing as the price of stock goes down. • High risk strategy. |

| Advantages | • Benefit from time decay. • Less capital required than buying the stock outright. • Profit when underlying stock price rise, move sideways or drop by a relatively small account. | • Capital investment is low and returns are high. • Unlimited reward, returns keep on increasing with the increase on stock price. • Leverage facility provided by this strategy is very beneficial. |