Compare Strategies

| STRIP | LONG STRANGLE | |

|---|---|---|

|

|

|

| About Strategy |

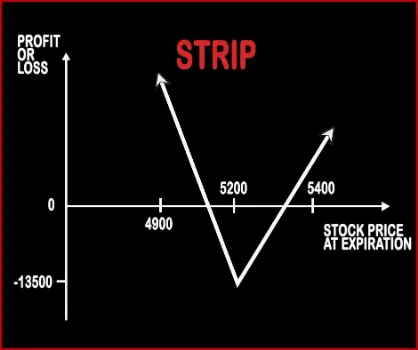

Strip Option StrategyStrip Strategy is the opposite of Strap Strategy. When a trader is bearish on the market and bullish on volatility then he will implement this strategy by buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date & underlying asset. If the prices move downwards then this strategy will make more profits compared to short straddle because of the |

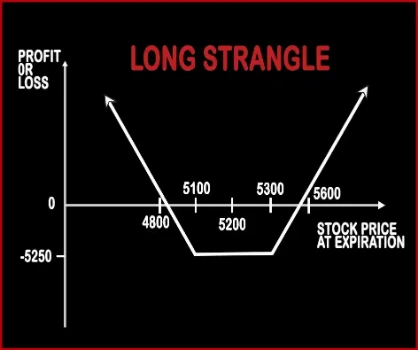

Long Strangle Option StrategyA Strangle is similar to Straddle. In Strangle, a trader will purchase one OTM Call Option and one OTM Put Option, of the same expiry date and the same underlying asset. This strategy will reduce the entry cost for trader and it is also cheaper than straddle. A trader will make profits, if the market moves sharply in either direction and gives extra-ordinary returns in the .. |

STRIP Vs LONG STRANGLE - Details

| STRIP | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Unlimited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

STRIP Vs LONG STRANGLE - When & How to use ?

| STRIP | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | When a trader is bearish on the market and bullish on volatility then he will implement this strategy. | This strategy is used in special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Action | Buy 1 ATM Call, Buy 2 ATM Puts | Buy OTM Call Option, Buy OTM Put Option |

| Breakeven Point | Upper Breakeven Point = Strike Price of Calls/Puts + Net Premium Paid, Lower Breakeven Point = Strike Price of Calls/Puts - (Net Premium Paid/2) | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

STRIP Vs LONG STRANGLE - Risk & Reward

| STRIP | LONG STRANGLE | |

|---|---|---|

| Maximum Profit Scenario | Price of Underlying - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - Price of Underlying) - Net Premium Paid | Profit = Price of Underlying - Strike Price of Long Call - Net Premium Paid |

| Maximum Loss Scenario | Net Premium Paid + Commissions Paid | Max Loss = Net Premium Paid |

| Risk | Limited | Limited |

| Reward | Unlimited | Unlimited |

STRIP Vs LONG STRANGLE - Strategy Pros & Cons

| STRIP | LONG STRANGLE | |

|---|---|---|

| Similar Strategies | Strap, Short Put Ladder | Long Straddle, Short Strangle |

| Disadvantage | Expensive., The share price must change significantly to generate profit., High Bid/Offer spread can have a negative influence on the position. | • Require significant price movement to book profit. • Traders can lose more money if the underlying asset stayed stagnant. |

| Advantages | Profit is generated when the share price changes in any direction., Limited loss., The profit is potentially unlimited when share prices are moving. | • Able to book profit, no matter if the underlying asset goes in either direction. • Limited loss to the debit paid. • If the underlying asset continues to move in one direction then you can book Unlimited profit . |