Compare Strategies

| LONG CALL CONDOR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

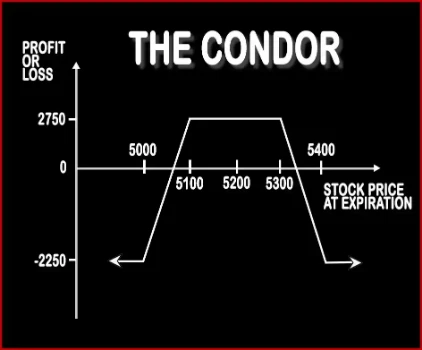

Long Call Condor Spread Option StrategyThis strategy is implemented when a trader is bearish on the volatility and expects the market to move sideways. Using Call Options of the same expiry date, he will buy one Deep ITM Call Option, sell 1 ITM Call Option, sell 1 OTM Call Option, buy 1 Deep OTM Call Option. The risk and reward both are limited due to offsetting of long and short positions. For t |

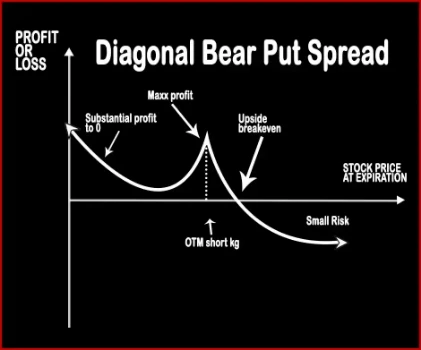

Diagonal Bear Put SpreadWhen the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset. This strategy bags limited rewards with limited risk. |

LONG CALL CONDOR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Details

| LONG CALL CONDOR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| Type (CE/PE) | CE (Call Option) | PE (Put Option) |

| Number Of Positions | 4 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Limited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

LONG CALL CONDOR SPREAD Vs DIAGONAL BEAR PUT SPREAD - When & How to use ?

| LONG CALL CONDOR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Market View | Neutral | Bearish |

| When to use? | This strategy works well when you expect the price of the underlying asset to be range bound in the coming days. | When the trader is neutral – bearish in the near-month and bearish in the mid-month, he will apply Diagonal Bear Put Spread. This strategy involves buying Mid-Month ITM Put Options and selling (short/write) equal number of Near-Month OTM Put Options, of the same underlying asset |

| Action | Buy Deep ITM Call Option, Buy Deep OTM Call Option, Sell ITM Call Option, Sell OTM Call Option | Sell 1 Near-Month OTM Put Option, Buy 1 Mid-Month ITM Put Option |

| Breakeven Point | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium | This is a dynamic trade with many possible scenarios and future trades, it is impossible to calculate a breakeven. |

LONG CALL CONDOR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Risk & Reward

| LONG CALL CONDOR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Lower Strike Short Call - Strike Price of Lower Strike Long Call - Net Premium Paid | 'Premiums received - Initial premium to execute + Strike price - Stock Price on final month |

| Maximum Loss Scenario | Net Premium Paid | When the stock trades up above the long-term put strike price. |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

LONG CALL CONDOR SPREAD Vs DIAGONAL BEAR PUT SPREAD - Strategy Pros & Cons

| LONG CALL CONDOR SPREAD | DIAGONAL BEAR PUT SPREAD | |

|---|---|---|

| Similar Strategies | Long Put Butterfly, Short Call Condor, Short Strangle | Bear Put Spread and Bear Call Spread |

| Disadvantage | • Amount of profit is comparatively low. • As this strategy has 4 legs so the brokerage cost is higher that will affect your profit. | Higher commissions due to additional trades. , Changes maximum profit potential of call or put spreads. |

| Advantages | • Capable to generate profit even if there is low volatility in the market. • This strategy is associated with limited risk and limited profit. • Wider profit zone. | The Risk is limited. |