Compare Strategies

| DIAGONAL BULL CALL SPREAD | LONG STRADDLE | |

|---|---|---|

|

|

|

| About Strategy |

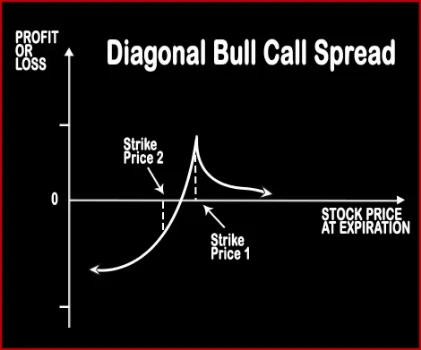

Diagonal Bull Call Spread Option StrategyThis strategy is implemented by a trader when he is neutral – moderately bullish in the near-month contract and bullish in the mid-month contract. It involves sale of 1 Near-Month OTM Call Option and buying of 1 Mid Month ITM Call Option. Risk:

|

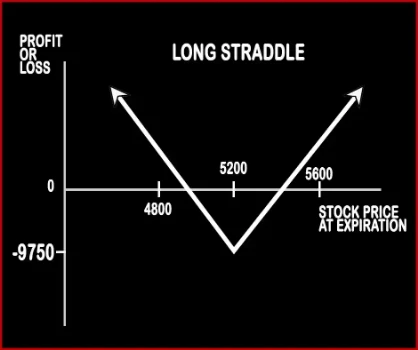

Long Straddle Option StrategyStraddle is neither bullish nor bearish strategy; it is a market neutral strategy. Here a trader wishes to take advantage of the volatility in the market. This strategy involves buying of one Call option and one Put option of the same strike price, same expiry date and of the same underlying asset. Now a trader is bound to make profits once stock moves in either direc .. |

DIAGONAL BULL CALL SPREAD Vs LONG STRADDLE - Details

| DIAGONAL BULL CALL SPREAD | LONG STRADDLE | |

|---|---|---|

| Market View | Bullish | Neutral |

| Type (CE/PE) | CE (Call Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Limited | Limited |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call + Net Premium |

DIAGONAL BULL CALL SPREAD Vs LONG STRADDLE - When & How to use ?

| DIAGONAL BULL CALL SPREAD | LONG STRADDLE | |

|---|---|---|

| Market View | Bullish | Neutral |

| When to use? | This options strategy is work well when and investor market view is bearish. The strategy minimizes your risk in the event of prime movements going against your expectations. | |

| Action | Buy 1 Long-Term ITM Call Sell 1 Near-Term OTM Call | Buy Call Option, Buy Put Option |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call + Net Premium |

DIAGONAL BULL CALL SPREAD Vs LONG STRADDLE - Risk & Reward

| DIAGONAL BULL CALL SPREAD | LONG STRADDLE | |

|---|---|---|

| Maximum Profit Scenario | Max profit is achieved when at one option is exercised. | |

| Maximum Loss Scenario | Maximum Loss = Net Premium Paid | |

| Risk | Limited | Limited |

| Reward | Limited | Unlimited |

DIAGONAL BULL CALL SPREAD Vs LONG STRADDLE - Strategy Pros & Cons

| DIAGONAL BULL CALL SPREAD | LONG STRADDLE | |

|---|---|---|

| Similar Strategies | Bull Put Spread | Bear Put Spread |

| Disadvantage | • There should be continuous movement of the stock and options price for this strategy to be profitable. • Time decay hurts long option if the strike price, expiration date or underlying stock are badly chosen. | |

| Advantages | • Unlimited potential beyond the breakeven point in either direction . • Book your profit from highly volatile stocks without determining the direction. • Limited risk, more profit. |