Compare Strategies

| SHORT STRADDLE | LONG STRANGLE | |

|---|---|---|

|

|

|

| About Strategy |

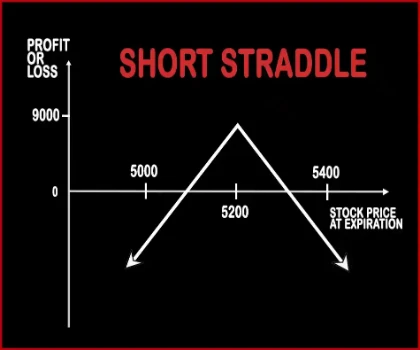

Short Straddle Option strategyThis strategy is just the opposite of Long Straddle. A trader should adopt this strategy when he expects less volatility in the near future. Here, a trader will sell one Call Option & one Put Option of the same strike price, same expiry date and of the same underlying asset. If the stock/index hovers around the same levels then both the options will expire worthless an |

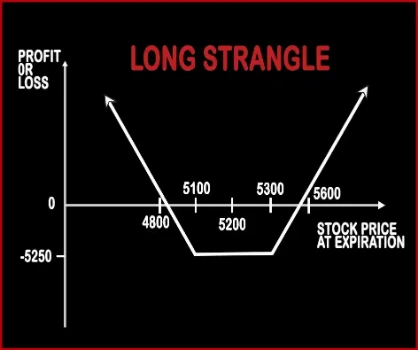

Long Strangle Option StrategyA Strangle is similar to Straddle. In Strangle, a trader will purchase one OTM Call Option and one OTM Put Option, of the same expiry date and the same underlying asset. This strategy will reduce the entry cost for trader and it is also cheaper than straddle. A trader will make profits, if the market moves sharply in either direction and gives extra-ordinary returns in the .. |

SHORT STRADDLE Vs LONG STRANGLE - Details

| SHORT STRADDLE | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| Type (CE/PE) | CE (Call Option) + PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 2 | 2 |

| Strategy Level | Advance | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

SHORT STRADDLE Vs LONG STRANGLE - When & How to use ?

| SHORT STRADDLE | LONG STRANGLE | |

|---|---|---|

| Market View | Neutral | Neutral |

| When to use? | This strategy is work well when an investor expect a flat market in the coming days with very less movement in the prices of underlying asset. | This strategy is used in special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Action | Sell Call Option, Sell Put Option | Buy OTM Call Option, Buy OTM Put Option |

| Breakeven Point | Lower Breakeven = Strike Price of Put - Net Premium, Upper breakeven = Strike Price of Call+ Net Premium | Lower Breakeven Point = Strike Price of Put - Net Premium, Upper Breakeven Point = Strike Price of Call + Net Premium |

SHORT STRADDLE Vs LONG STRANGLE - Risk & Reward

| SHORT STRADDLE | LONG STRANGLE | |

|---|---|---|

| Maximum Profit Scenario | Max Profit = Net Premium Received - Commissions Paid | Profit = Price of Underlying - Strike Price of Long Call - Net Premium Paid |

| Maximum Loss Scenario | Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received | Max Loss = Net Premium Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

SHORT STRADDLE Vs LONG STRANGLE - Strategy Pros & Cons

| SHORT STRADDLE | LONG STRANGLE | |

|---|---|---|

| Similar Strategies | Short Strangle | Long Straddle, Short Strangle |

| Disadvantage | • Unlimited risk. • If the price of the underlying asset moves in either direction then huge losses can occur. | • Require significant price movement to book profit. • Traders can lose more money if the underlying asset stayed stagnant. |

| Advantages | • A trader can earn profit even when there is no volatility in the market . • Allows you to benefit from double time decay. • Trader can collect premium from puts and calls option . | • Able to book profit, no matter if the underlying asset goes in either direction. • Limited loss to the debit paid. • If the underlying asset continues to move in one direction then you can book Unlimited profit . |