Compare Strategies

| PROTECTIVE PUT | STRAP | |

|---|---|---|

|

|

|

| About Strategy |

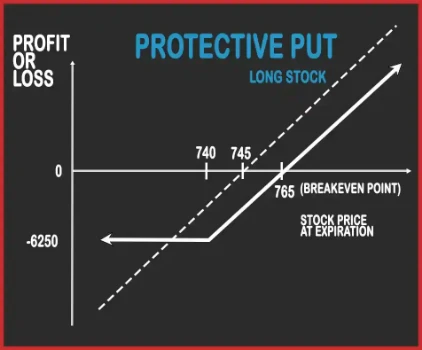

Protective Put Option StrategyProtective Put Strategy is a hedging strategy where trader guards himself from the downside risk. This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. He will buy one ATM Put Option to hedge his position. Now, if the underlying asset moves either up or down, the trader is in a safe position.

|

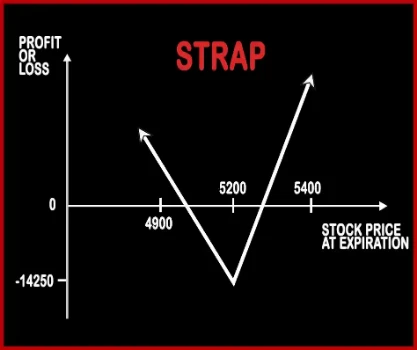

Strap Option StrategyStrap Strategy is similar to Long Straddle, the only difference is the quantity traded. A trader will buy two Call Options and one Put Options. In this strategy, a trader is very bullish on the market and volatility on upside but wants to hedge himself in case the stock doesn’t perform as per his expectations. This strategy will make more profits compared to long straddle sin .. |

PROTECTIVE PUT Vs STRAP - Details

| PROTECTIVE PUT | STRAP | |

|---|---|---|

| Market View | Bullish | Neutral |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 1 | 3 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Unlimited | Profit Achieved When Price of Underlying > Strike Price of Calls/Puts + (Net Premium Paid/2) OR Price of Underlying < Strike Price of Calls/Puts - Net Premium Paid |

| Risk Profile | Limited | Max Loss Occurs When Price of Underlying = Strike Price of Calls/Puts |

| Breakeven Point | Purchase Price of Underlying + Premium Paid | Strike Price of Calls/Puts + (Net Premium Paid/2) |

PROTECTIVE PUT Vs STRAP - When & How to use ?

| PROTECTIVE PUT | STRAP | |

|---|---|---|

| Market View | Bullish | Neutral |

| When to use? | This strategy is adopted when a trader is long on the underlying asset but skeptical of the downside. | This strategy is used when the investor is bullish on the stock and expects volatility in the near future. |

| Action | Buy 1 ATM Put | Buy 2 ATM Call Option, Buy 1 ATM Put Option |

| Breakeven Point | Purchase Price of Underlying + Premium Paid | Strike Price of Calls/Puts + (Net Premium Paid/2) |

PROTECTIVE PUT Vs STRAP - Risk & Reward

| PROTECTIVE PUT | STRAP | |

|---|---|---|

| Maximum Profit Scenario | Price of Underlying - Purchase Price of Underlying - Premium Paid | UNLIMITED |

| Maximum Loss Scenario | Premium Paid + Purchase Price of Underlying - Put Strike + Commissions Paid | Net Premium Paid |

| Risk | Limited | Limited |

| Reward | Unlimited | Unlimited |

PROTECTIVE PUT Vs STRAP - Strategy Pros & Cons

| PROTECTIVE PUT | STRAP | |

|---|---|---|

| Similar Strategies | Long Call, Call Backspread | Strip, Short Put Ladder, Short Call Ladder |

| Disadvantage | • Value of protective put position decreases as time passes • Holding period of the protective put can be affected by the timing as a result tax rate on the profit or loss from the stock can be affected. | • To generate profit, there should be significant change in share price. • Expensive strategy. |

| Advantages | • Unlimited potential profit due to indefinitely rise in the underlying stock price . • This strategy allows you to hold on to your stocks while insuring against losses. • Hedging strategy, trader can guard himself from the downside risk. | • Limited loss. • If share prices are moving then traders can book unlimited profit. • A trader can still book profit if the underlying falls substantially. |