Can NRIs Trade in Cryptocurrencies in India

Cryptocurrency Trading has gained popularity globally, and many non-resident Indians (NRIS) are interested in investing in digital assets. However, India's regulatory structure is complex around crypto trade, which requires understanding of validity before investing for NRIs.

Current Legal Status of Cryptocurrency in India

So far, cryptocurrency trade in India has not been banned in

India, but is not recognized as a legal tender. Reserve Bank of India (RBI) had

previously banned the crypto transactions, which was removed by the Supreme

Court in 2020. However, the government of India has introduced a tax policy for

crypto in India revenue, which indicates a regulated approach rather than a

ban.

Can NRIs Trade Cryptocurrencies in India?

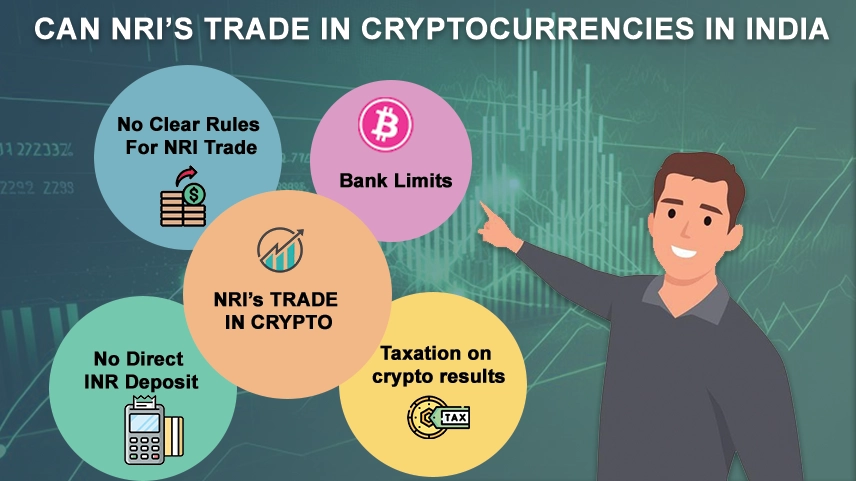

NRIs face challenges when trading cryptocurrencies in India due to regulatory and banking restrictions. Here are key factors to consider:

1. No clear rules for NRI trade - India's government has clearly mentioned whether NRI can act cryptocurrency on Indian stock exchanges.

2. Bank limits - most Indian banks do not support Cryptocurrency transactions for NRIs due to the rules of the Currency Cost Act (FEMA).

3. No direct INR deposit -NRI RBI cannot finance Indian cryptout exchange accounts using the NR/NRA accounts according to guidelines.

4. Taxation on crypto results - If NRI earns at crypto trade in India, they will have to pay 30% tax on the profits in accordance with 2022 Crypto Taxation Policy.

Alternative Ways NRIs Can Invest in Crypto

Since Indian exchanges have restrictions, NRIs can explore

other ways to invest in cryptocurrencies:

- Foreign

Crypto Exchanges: NRIs can use international platforms like Binance,

Kraken, and Coinbase, which do not have Indian jurisdiction restrictions.

- Peer-to-Peer

(P2P) Trading: Some Indian crypto exchanges offer P2P options where

users can trade directly without involving banks.

- Investing

Through Foreign Bank Accounts: Nri Cryptocurrency can invest in crypto

through their resident country’s banking system, avoiding Indian

restrictions.

Things NRIs Should Keep in Mind

- Always

check tax implications in both India and the country of residence.

- Use

exchanges that comply with global KYC and AML regulations.

- Keep

track of regulatory updates, as crypto laws in India are still evolving.

Conclusion

While NRI can trade cryptocurrency, direct trade in Indian

stock exchanges is challenging due to regulatory restrictions. Investing

through global stock exchanges or foreign bank accounts is a better

alternative. When India is moving towards clear rules, NRIS should remain

updated to make informed investment decisions.

Read Also

Can an NRI do Intraday Trading in India

Can Nri Invest in Mutual Funds

0 comments