Ease of Movement Indicator (EOM)

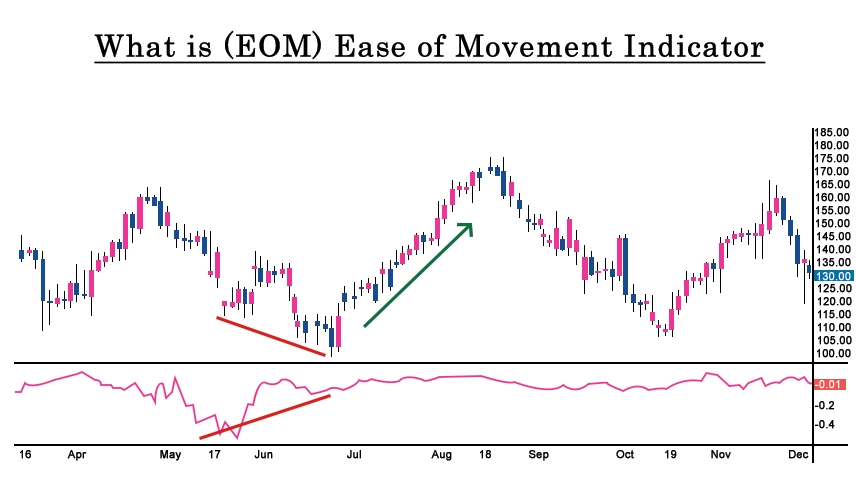

What is EOM Ease of Movement Indicator

Ease of Movement Meaning Ease of Movement Indicator is a technical analysis tool used by traders to assess the relationship between price movement and volume. EOM developed by Richard W. Arms, Jr, is designed to help traders identify potential trend reversal or confirm existing trends. It aims to quantify the ease or difficulty of price movements based on volume flows.

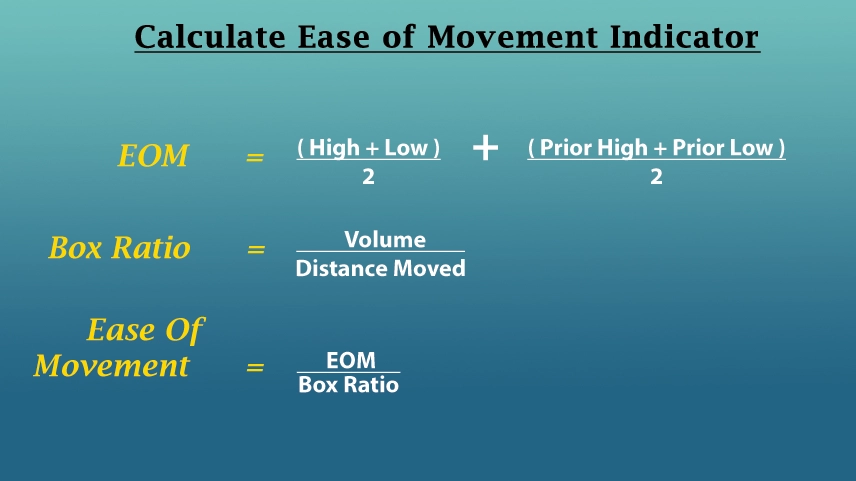

Calculate Ease of Movement Indicator

EOM Ease of Movement Indicator calculated.

1. Distance Moved: Calculate the distance moved by the price during a specific period. It’s calculated the high minus the Low for each period.

2. Box Ratio: Determine the box ratio which is the ratio of the volume to the distance moved this measure how much volume is required to move the price by one unit.

3. Ease of movement value: EOM Indicator is then calculated by dividing the price change (distance moved) by the box ratio.

Pros and Cons

Pros

1. EOM Ease of Movement Indicator Strategy incorporates volume data into its calculations, volume confirmation providing insight into the relationship between price movements and trading volume. It helps confirm the strength or weakness of a price trend.

2. EOM can be used to confirm the strength of an existing trend if the indicator aligns with the direction of the price trend.

3. Simple Calculation EOM ease of movement trading indicators have relatively simple calculations compared to some other technical indicators, making it easy to understand and implement.

Cons

1. EOM relies on volume data, volume quality but not all volume is equal. In some cases, Volume may not accurately reflect genuine interest or participation in the market.

2. EOM is subject to price fluctuations and can generate false signals, traders may need to use additional filters or indicators to reduce false signals.

3. EOM can vary depending on the time frame or period selected for analysis. Different periods may produce different signals.

4. EOM signals require subjective judgement, traders may have differing opinions on the significance of signals or patterns.

Conclusion

Ease of Movement (EOM) indicator offers traders insights into price and volume dynamics, aiding in trend confirmation and divergence detection. Despite its simplicity and ability to incorporate volume data, it has limitations such as lag and dependence on period selection. Thus, while valuable, it's most effective when used with other indicators for a comprehensive trading strategy.

0 comments