Commodity Channel Index: Strategies, Limitations, and Conclusion

What is the Commodity Channel Index (CCI)

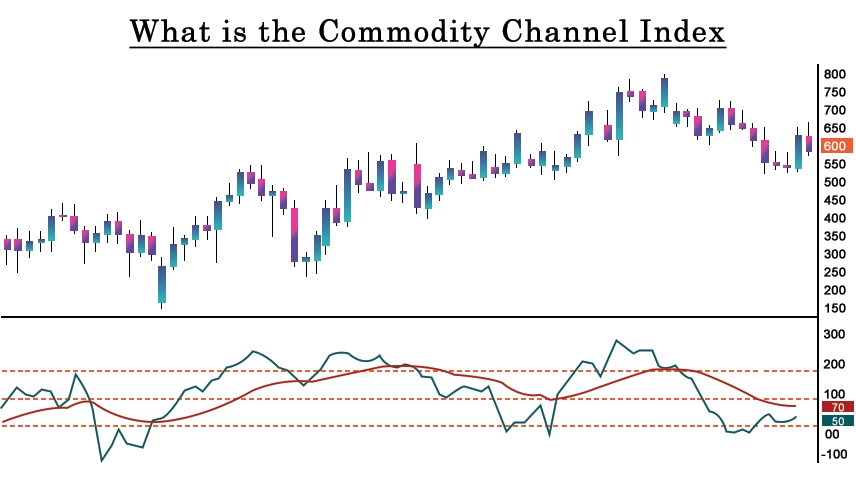

The commodity channel index (CCI) measures how far an asset’s price has the deviated from its historical average. It helps the traders recognize potential trend reversals and confirm existing trends. The indicator oscillates above and below a zero line, with extreme values indicating overbought or oversold conditions.

How is Commodity Channel Index CCI Calculated

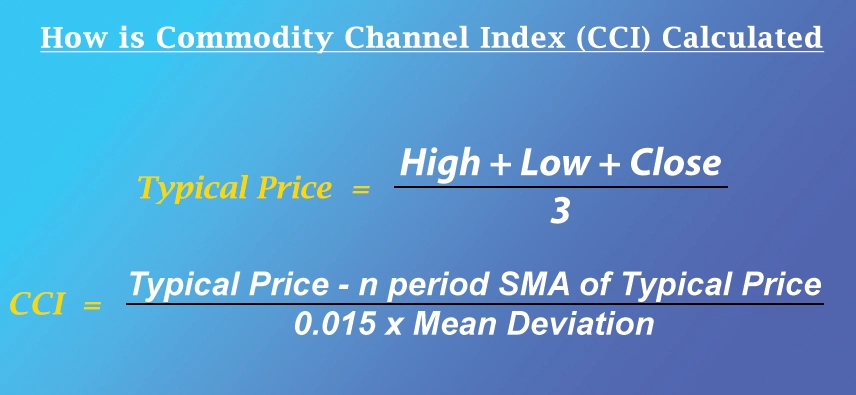

The formula for CCI is:

Where:

• Typical Price (TP) = (High + Low + Close) / 3

• SMA = Simple Moving Average of the Typical Price

• Mean Deviation = Average absolute deviation from the SMA

• 0.015 = A constant factor used to keep most values within the -100 to +100 range

Trading Strategies Using CCI

1. Overbought & Oversold Conditions:

When CCI rises above +100, traders may consider selling or taking profits.

When CCI falls below -100, traders may look for buying opportunities.

2. Divergence Trading:

Bullish Divergence: If the price makes a lower low while the commodity channel index indicator makes a higher low, it signals a potential upward reversal.

Bearish Divergence: If the price makes a higher high while the CCI forms a lower high, it indicates a possible downward reversal.

3. Breakout Confirmation:

If the commodity channel index indicador moves above +100 and the price breaks a key resistance level, it may confirm a strong uptrend.

If the CCI drops below -100 and the price breaks a support level, it may confirm a downtrend.

Limitations of CCI

• False Signals: CCI can generate misleading signals, especially in sideways markets.

• Lagging Indicator: Since it relies on past prices, it may not always provide timely entry and exit points.

• Best Used with Other Indicators: Traders often combine CCI with tools like RSI, MACD, or moving averages for better accuracy.

Conclusion

The Commodity Channel Index (CCI) is a powerful tool for identifying overrun and over-sold conditions, spot leads, and confirming trends. However, it should not be used insulated. With other technical indicators and noise risk management, traders can make more informed decisions and improve their business strategies.

Although CCI can be very effective, it is necessary to understand its limitations and use it in combination with basic analysis and market conditions. Proper testing and practice for back and practice can help traders get the confidence to use CCI effectively. In addition, maintaining a disciplined approach and adaptation to market changes will increase the overall success of business strategies involving CCI.

0 comments