Compare Strategies

| RATIO PUT SPREAD | BULL CALENDER SPREAD | |

|---|---|---|

|

|

|

| About Strategy |

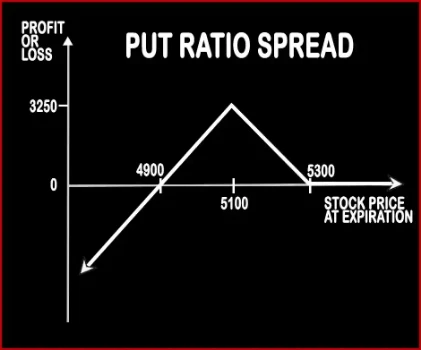

Ratio Put Spread Option StrategyThis strategy involves buying ITM Puts and simultaneously selling OTM Puts, double the number of ITM Puts. This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. Here profits will be capped up to the premium amount and risk will be potentially unlimited. |

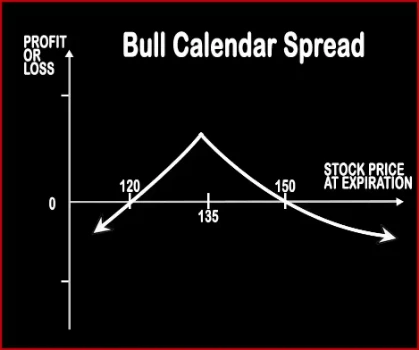

Bull Calendar Spread Option StrategyThis strategy is implemented when a trader is bullish on the underlying stock/index in the short term say 2 months or so. A trader will write one Near Month OTM Call Option and buy one next Month OTM Call Option, thereby reducing the cost of purchase, with the same strike price of the same underlying asset. This strategy is used when a trader wants to make prof .. |

RATIO PUT SPREAD Vs BULL CALENDER SPREAD - Details

| RATIO PUT SPREAD | BULL CALENDER SPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| Type (CE/PE) | PE (Put Option) | CE (Call Option) + PE (Put Option) |

| Number Of Positions | 3 | 2 |

| Strategy Level | Beginners | Beginners |

| Reward Profile | Limited | Unlimited |

| Risk Profile | Unlimited | Limited |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) | Stock Price when long call value is equal to net debit. |

RATIO PUT SPREAD Vs BULL CALENDER SPREAD - When & How to use ?

| RATIO PUT SPREAD | BULL CALENDER SPREAD | |

|---|---|---|

| Market View | Neutral | Bullish |

| When to use? | This strategy is used by a trader who is neutral on the market and bearish on the volatility in the near future. | This strategy is used when a trader wants to make profit from a steady increase in the stock price over a short period of time. |

| Action | Buy 1 ITM Put, Sell 2 OTM Puts | Sell 1 Near-Term OTM Call, Buy 1 Long-Term OTM Call |

| Breakeven Point | Upper Breakeven Point = Strike Price of Long Put +/- Net Premium Received or Paid, Lower Breakeven Point = Strike Price of Short Puts - (Points of Maximum Profit / Number of Uncovered Puts) | Stock Price when long call value is equal to net debit. |

RATIO PUT SPREAD Vs BULL CALENDER SPREAD - Risk & Reward

| RATIO PUT SPREAD | BULL CALENDER SPREAD | |

|---|---|---|

| Maximum Profit Scenario | Strike Price of Long Put - Strike Price of Short Put + Net Premium Received - Commissions Paid | You have unlimited profit potential to the upside. |

| Maximum Loss Scenario | Strike Price of Short - Price of Underlying - Max Profit + Commissions Paid | Max Loss = Premium Paid + Commissions Paid |

| Risk | Unlimited | Limited |

| Reward | Limited | Unlimited |

RATIO PUT SPREAD Vs BULL CALENDER SPREAD - Strategy Pros & Cons

| RATIO PUT SPREAD | BULL CALENDER SPREAD | |

|---|---|---|

| Similar Strategies | Short Straddle (Sell Straddle), Short Strangle (Sell Strangle) | The Collar, Bull Put Spread |

| Disadvantage | • Unlimited potential risk. • Limited profit. | • Limited profit even if underlying asset rallies. • If the short call options are assigned when the underlying asset rallies then losses can be sustained. |

| Advantages | • Directional strategy so that there is either no upside or downside risk. • Able to profit even if trader is neutral on the market. • Higher probability of profit. | • Limited losses to the net debit. • Enable trader to book profit even if underlying asset stays stagnant. • If the market trends reverse, cashing in from stock price movement at limited risk. |